In the world of trading, understanding trading charts is like having a map to navigate through the financial seas. Whether you're a seasoned investor or a beginner looking to dive into the stock market, mastering the art of reading charts can significantly enhance your trading success. This comprehensive guide will explore the types of trading charts, their significance, and how to interpret them effectively.

Understanding Trading Charts

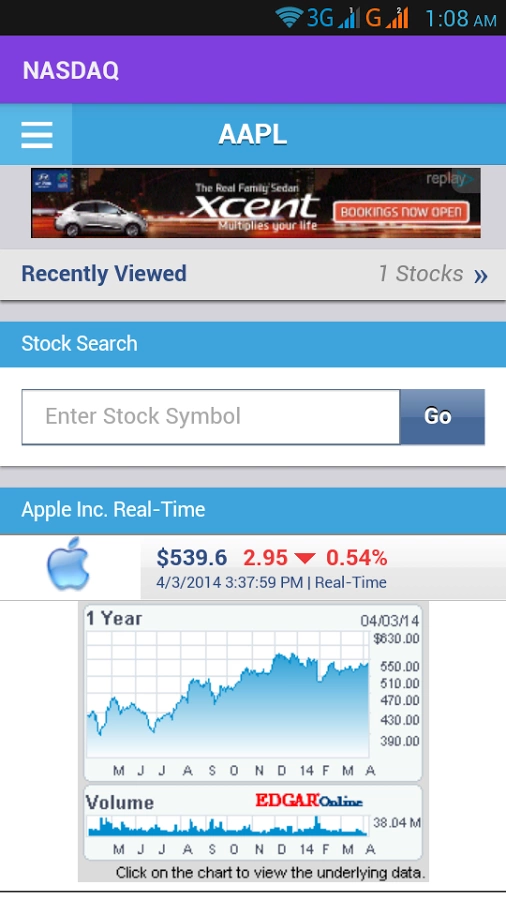

Trading charts are graphical representations of financial instruments' price movements over a specific period. They are crucial tools for traders and investors as they provide a visual way to analyze market trends, identify potential entry and exit points, and make informed trading decisions.

Types of Trading Charts

- Line Charts: These charts show the closing price of a security over a specific period. They are the simplest and most commonly used type of chart.

- Bar Charts: Also known as OHLC (open, high, low, close) charts, these provide more detailed information than line charts, including the opening and closing prices, as well as the highest and lowest prices during the trading day.

- Candlestick Charts: Similar to bar charts, candlestick charts offer detailed price information. However, they are more visually appealing and often used by traders to spot patterns and trends.

- Area Charts: These charts are similar to line charts but include the price range, providing a visual representation of the total price action.

Interpreting Trading Charts

Interpreting trading charts involves analyzing various technical indicators and patterns. Here are some key aspects to consider:

- Trends: Identify whether the market is trending up, down, or sideways. Trend lines can help you visualize and confirm these trends.

- Support and Resistance: These levels indicate where the market is likely to reverse. Traders often look for buy opportunities near support levels and sell opportunities near resistance levels.

- Patterns: Patterns such as head and shoulders, triangles, and flags can indicate potential future price movements.

- Volume: Analyzing trading volume can provide insights into the strength of a trend. For example, an uptrend with increasing volume is generally considered more robust.

Case Study: Identifying a Breakout

Imagine you are analyzing a stock's trading chart, and you notice that it has formed a symmetrical triangle pattern. The stock has been consolidating within this pattern for several weeks, and the price has recently broken out above the upper trend line. Alongside this, you observe that the trading volume has significantly increased during the breakout, indicating strong buying interest.

In this scenario, you might consider taking a long position in the stock, anticipating further upward momentum.

Final Thoughts

Trading charts are powerful tools that can help you make informed trading decisions. By understanding the different types of charts, interpreting patterns, and analyzing technical indicators, you can improve your chances of success in the stock market. Remember, practice and experience are key to mastering the art of reading trading charts.

Note: Always remember to do thorough research and consider consulting with a financial advisor before making any trading decisions.

American stock trading