The Dow Jones Industrial Average (DJIA), a widely followed stock market index, has recently experienced a downward trend, sparking concerns among investors. This article delves into the reasons behind the DJIA's decline and its potential impact on the broader market.

Economic Factors Contributing to the DJIA's Decline

Several economic factors have contributed to the recent downward trend in the DJIA. One of the primary reasons is the rising interest rates. The Federal Reserve has been increasing interest rates to combat inflation, which has led to higher borrowing costs for businesses and consumers. This, in turn, has negatively impacted corporate earnings and investor sentiment.

Geopolitical Tensions

Geopolitical tensions have also played a significant role in the DJIA's decline. Concerns over the conflict in Eastern Europe and the potential for a global economic slowdown have caused investors to become more cautious. Additionally, trade disputes between major economies have created uncertainty and volatility in the stock market.

Technological Sector's Influence

The technology sector, which has been a major driver of the DJIA's growth over the past few years, has also experienced a downturn. Companies like Apple and Microsoft, which are part of the DJIA, have seen their stock prices decline due to concerns about slowing growth and increased competition.

Impact on the Broader Market

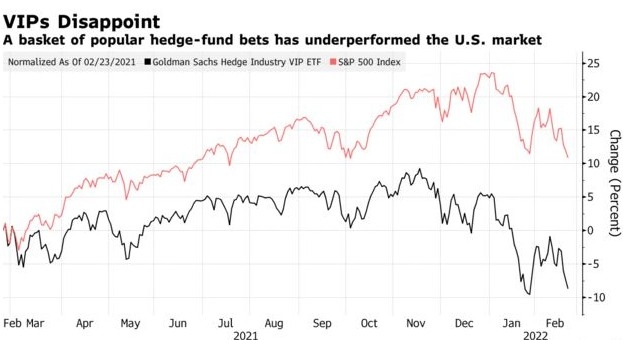

The DJIA's decline has had a ripple effect on the broader market. Many other stock indices, including the S&P 500 and the NASDAQ, have also experienced downward trends. This has raised concerns about a potential bear market, which is characterized by a sustained decline in stock prices.

Case Studies: Apple and Microsoft

Two notable examples of the impact of the DJIA's decline are Apple and Microsoft. Both companies have seen their stock prices decline significantly over the past few months. Apple's stock price has dropped by nearly 20% since the beginning of the year, while Microsoft's stock has fallen by approximately 15%.

Conclusion

The recent decline in the DJIA has been driven by a combination of economic factors, geopolitical tensions, and sector-specific issues. While this has caused concern among investors, it is important to remember that stock market volatility is a normal part of the investment cycle. As always, it is crucial for investors to stay informed and make decisions based on their individual risk tolerance and investment goals.

American stock trading