In the ever-evolving world of finance, understanding the relationship between money and markets is crucial for anyone looking to invest wisely. Whether you're a seasoned investor or just starting out, the dynamics of money and markets play a pivotal role in shaping your financial future. This article delves into the intricacies of this relationship, offering insights and strategies to help you navigate the complex world of investments.

Understanding the Market

The first step in mastering the art of investment is to understand the market itself. The market refers to the aggregate of buyers and sellers who trade financial securities such as stocks, bonds, and commodities. It is influenced by a variety of factors, including economic indicators, geopolitical events, and investor sentiment.

One of the key concepts to grasp is the supply and demand dynamics. When demand for a particular security increases, its price typically rises, and vice versa. This is known as the law of supply and demand, a fundamental principle in economics.

The Role of Money

Money, on the other hand, is the medium of exchange that facilitates transactions in the market. It is the currency used to measure the value of assets and liabilities. In the context of investment, money plays a critical role in determining the return on investment (ROI) and the risk associated with different investment vehicles.

Investment Strategies

To succeed in the market, it's essential to develop a robust investment strategy. Here are some key strategies to consider:

- Diversification: This involves spreading your investments across different asset classes to reduce risk. By diversifying, you can protect your portfolio from the volatility of any single investment.

- Risk Management: Assessing and managing your risk tolerance is crucial. This involves understanding your financial goals, time horizon, and the potential risks associated with different investments.

- Long-term Investing: Investing for the long term can help mitigate the impact of short-term market fluctuations and increase the likelihood of achieving your financial objectives.

Case Study: The Tech Boom

A prime example of the interplay between money and markets is the tech boom of the late 1990s and early 2000s. During this period, technology stocks surged in value, driven by the rapid growth of the internet and the rise of tech giants like Microsoft and Intel. Investors who took advantage of this trend by investing in these companies saw significant returns. However, those who got caught up in the hype and invested heavily in overvalued stocks suffered substantial losses when the bubble burst in 2000.

Conclusion

Understanding the relationship between money and markets is essential for anyone looking to succeed in the world of investments. By adopting a well-thought-out investment strategy and staying informed about market trends, you can navigate the complexities of the market and achieve your financial goals. Remember, investing is a marathon, not a sprint, and patience and discipline are key to long-term success.

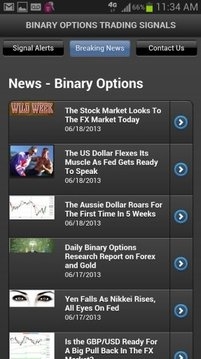

American stock trading