Dubai(1)Strat(5)from(90)Stocks(1515)Invest(153)

Are you considering investing in US stocks but are based in Dubai? If so, you're not alone. Dubai's growing financial hub has attracted investors from around the world, eager to tap into the American stock market's potential. In this article, we will explore the process of investing in US stocks from Dubai, including the benefits, potential risks, and the best strategies to get started.

Understanding the US Stock Market

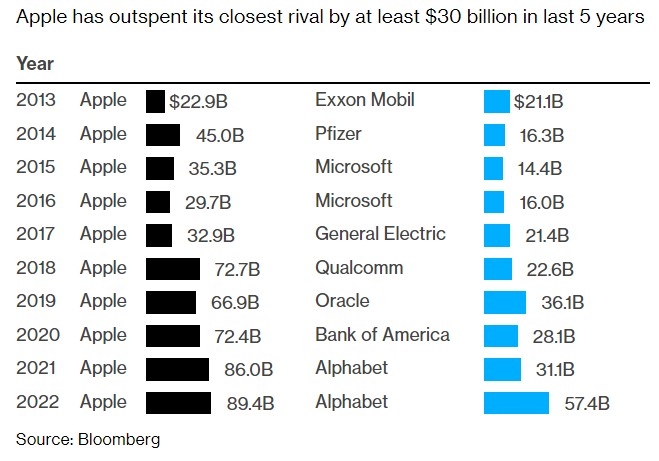

The US stock market is one of the most robust and liquid in the world. It's home to some of the most influential companies, including tech giants like Apple, Google, and Microsoft, as well as established industries like energy, finance, and healthcare. Investing in US stocks can offer numerous benefits, such as:

- Diversification: Investing in a variety of US stocks can help you spread your risk and reduce the impact of market fluctuations.

- Potential for High Returns: Historically, the US stock market has offered higher returns than other markets, making it an attractive option for long-term investors.

- Access to Global Companies: Investing in US stocks allows you to gain exposure to some of the world's most successful companies, regardless of your location.

Investing from Dubai: The Process

Investing in US stocks from Dubai involves several steps. Here's what you need to know:

Choose a Broker: To buy US stocks, you'll need a brokerage account. There are several reputable brokers that cater to international clients, such as TD Ameritrade, E*TRADE, and Charles Schwab.

Open a Brokerage Account: Once you've chosen a broker, you'll need to open a brokerage account. This typically involves filling out an application, providing identification, and verifying your account. Be sure to read the terms and conditions carefully to understand any fees or restrictions.

Fund Your Account: Once your account is open, you'll need to fund it. You can do this by transferring funds from your Dubai bank account or by using an international wire transfer.

Research and Select Stocks: Research the companies you're interested in and determine your investment strategy. You can use financial websites, investment newsletters, and stock analysis tools to help you make informed decisions.

Buy and Sell Stocks: Once you've chosen your stocks, you can place buy and sell orders through your brokerage account. Keep in mind that stock prices can fluctuate rapidly, so be prepared to act quickly if you're investing in volatile stocks.

Benefits of Investing in US Stocks from Dubai

Investing in US stocks from Dubai offers several unique benefits:

- Access to Global Opportunities: Dubai's strategic location allows investors to tap into the global market without leaving their home country.

- Diverse Investment Options: Dubai's financial hub offers a wide range of investment options, from individual stocks to exchange-traded funds (ETFs) and mutual funds.

- Professional Support: Dubai is home to numerous financial advisors and wealth management firms that can help you navigate the US stock market and develop a tailored investment strategy.

Potential Risks

While investing in US stocks from Dubai offers numerous benefits, it's important to be aware of the potential risks:

- Currency Fluctuations: Changes in the exchange rate between the UAE dirham and the US dollar can impact your investment returns.

- Regulatory Differences: There may be differences in regulations between the UAE and the US, which could affect your investment strategy.

- Market Volatility: The US stock market can be volatile, and investing in individual stocks can expose you to higher risk.

Conclusion

Investing in US stocks from Dubai can be a rewarding opportunity for investors looking to diversify their portfolio and gain access to global markets. By understanding the process, benefits, and risks, you can develop a strategic approach to investing in US stocks from Dubai and achieve your financial goals.

American stock trading