In today's fast-paced business environment, the art of markets trade is crucial for anyone looking to thrive. Whether you're an experienced investor or a beginner venturing into the world of finance, understanding the intricacies of market trading is key to unlocking potential profits. This article delves into essential strategies and techniques to help you excel in markets trade.

Understanding the Markets

Before diving into the nitty-gritty of trading, it's crucial to have a solid grasp of the various markets available. From stocks and bonds to commodities and currencies, each market offers unique opportunities and challenges. Understanding the fundamental differences between these markets can help you tailor your strategy to your goals and risk tolerance.

Developing a Trading Plan

One of the most important aspects of successful markets trade is having a well-defined trading plan. This plan should outline your trading objectives, risk management strategies, and exit strategies. By sticking to a structured approach, you can minimize impulsive decisions and stay focused on your long-term goals.

Risk Management

Effective risk management is a cornerstone of successful trading. One of the most crucial aspects of risk management is knowing how much you can afford to lose on any given trade. Setting strict stop-loss orders can help protect your capital and prevent significant losses. Additionally, diversifying your portfolio can help mitigate the impact of market volatility.

Technical Analysis

Technical analysis involves analyzing past market data to identify patterns and trends that can predict future price movements. Tools like charts, indicators, and oscillators can provide valuable insights into market behavior. By studying technical analysis, you can make informed decisions based on historical data and market momentum.

Fundamental Analysis

In addition to technical analysis, fundamental analysis involves examining economic, financial, and qualitative factors that affect market prices. This includes analyzing financial statements, economic reports, and company news. By combining technical and fundamental analysis, you can gain a comprehensive understanding of the market and make more informed trading decisions.

Case Studies: Real-World Applications

Let's consider a real-world example. Suppose you're interested in trading stocks. By analyzing both the technical and fundamental aspects of a company, you can identify potential entry and exit points. For instance, a stock with strong technical indicators and positive fundamental news may present a good buying opportunity.

Implementing Successful Strategies

To succeed in markets trade, it's essential to:

- Stay Informed: Keep up with the latest market news, economic indicators, and company updates.

- Practice Patience: Avoid making impulsive decisions based on short-term market fluctuations.

- Continuous Learning: Stay open to new information and adapt your strategy as the market evolves.

By incorporating these strategies into your trading approach, you can enhance your chances of success in the world of markets trade.

In conclusion, mastering the art of markets trade requires a combination of knowledge, discipline, and continuous learning. By understanding the markets, developing a solid trading plan, managing risk effectively, and utilizing both technical and fundamental analysis, you can increase your chances of achieving your financial goals. Remember, successful trading is a journey, not a destination.

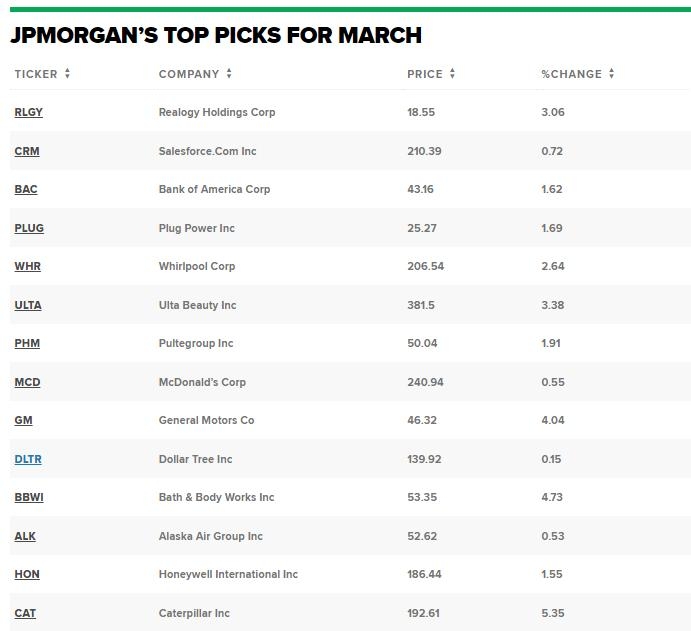

American stock news