Investing in US stocks can be a lucrative opportunity for Canadian investors. With the right strategy and knowledge, you can tap into the vast potential of the American stock market. This article provides a comprehensive guide to help Canadian investors navigate the US stock market effectively.

Understanding the Basics

Before diving into the US stock market, it's crucial to understand the basics. The US stock market is one of the largest and most liquid in the world, offering a wide range of investment opportunities. Here are some key points to consider:

- Stock Market Indices: The S&P 500, Dow Jones, and NASDAQ are popular stock market indices that track the performance of a basket of stocks. Understanding these indices can help you gauge the overall market trends.

- Types of Stocks: There are various types of stocks, including common stocks, preferred stocks, and exchange-traded funds (ETFs). Each type has its own characteristics and risk-reward profile.

- Trading Hours: The US stock market operates from 9:30 AM to 4:00 PM Eastern Standard Time (EST). It's important to be aware of these hours when planning your investments.

Choosing the Right Brokerage

Selecting the right brokerage is essential for Canadian investors looking to invest in US stocks. Here are some factors to consider when choosing a brokerage:

- Regulatory Compliance: Ensure that the brokerage is regulated by a reputable financial authority, such as the Securities and Exchange Commission (SEC) in the US.

- Fees and Commissions: Compare the fees and commissions charged by different brokers to find the most cost-effective option.

- Customer Service: Look for a brokerage with excellent customer service, including responsive support and educational resources.

Top US Stocks for Canadian Investors

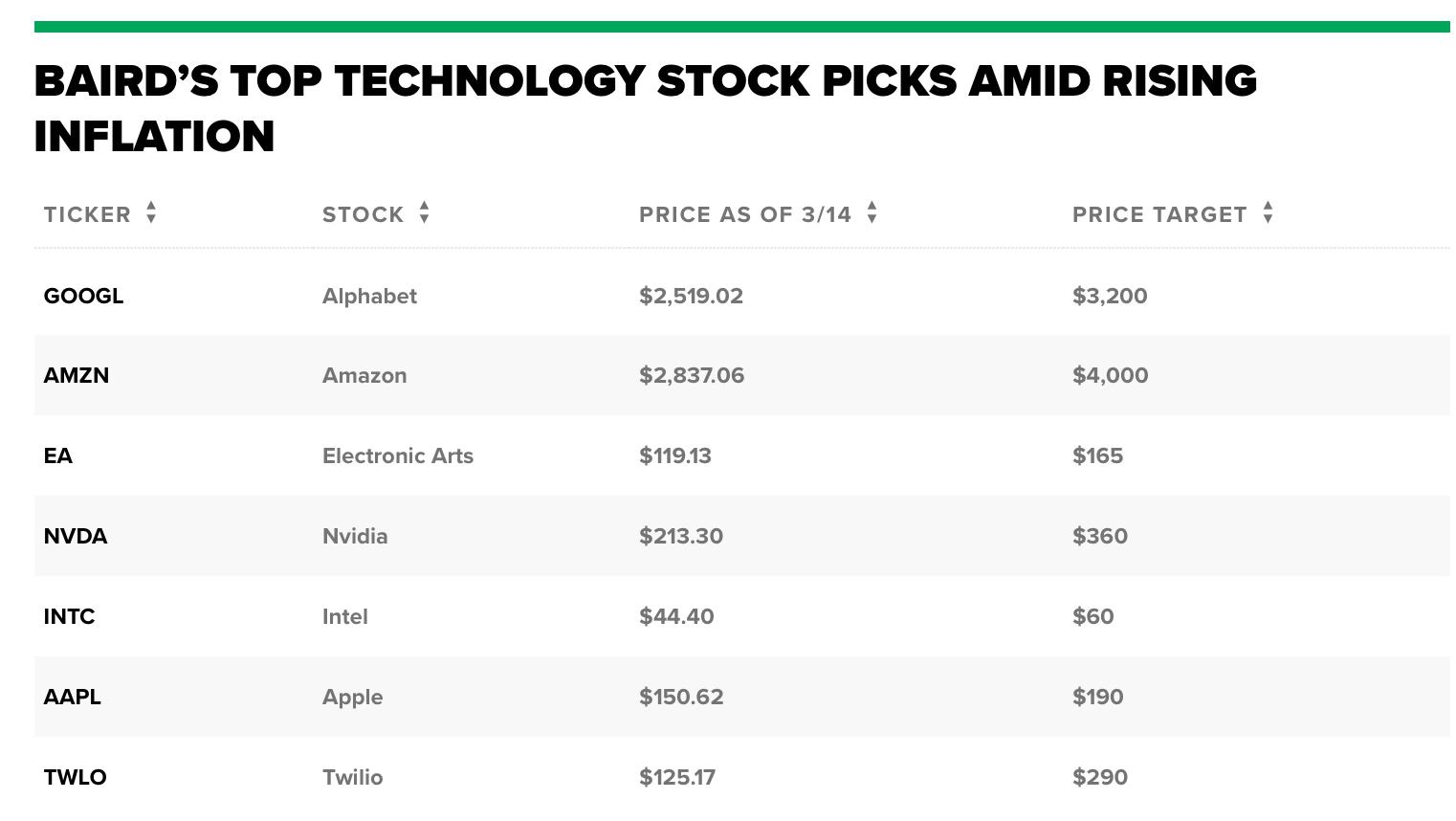

Several US stocks have proven to be excellent investments for Canadian investors. Here are some notable examples:

- Apple (AAPL): As one of the world's largest technology companies, Apple has a strong track record of growth and innovation.

- Microsoft (MSFT): Microsoft is a leading player in the software and cloud computing industries, with a diverse product portfolio.

- Amazon (AMZN): Amazon is a dominant force in e-commerce and cloud computing, offering significant growth potential.

- Tesla (TSLA): Tesla is a leader in electric vehicles and renewable energy, with a strong brand and innovative technology.

Case Study: Investing in Apple (AAPL)

Let's consider a hypothetical scenario where a Canadian investor decides to invest in Apple (AAPL). Here's how they could approach this investment:

- Research: Conduct thorough research on Apple's financials, market position, and growth prospects.

- Diversification: Allocate a portion of their investment portfolio to Apple, ensuring a well-diversified portfolio.

- Monitoring: Regularly monitor Apple's stock performance and market trends to make informed decisions.

Conclusion

Investing in US stocks can be a valuable addition to a Canadian investor's portfolio. By understanding the basics, choosing the right brokerage, and selecting the right stocks, Canadian investors can capitalize on the opportunities offered by the US stock market.

American stock news