In the dynamic world of stock trading, the average holding period for stocks is a critical metric that investors closely monitor. This article delves into what the average holding period means, its significance, and how it reflects the investment strategies of individuals and institutions in the United States.

What is the Average Holding Period?

The average holding period for stocks refers to the duration that an investor holds a particular stock before selling it. This period can range from a few days to several years, depending on the investor's strategy and market conditions.

Significance of the Average Holding Period

Investment Strategy: The average holding period is a reflection of an investor's strategy. Long-term investors typically hold stocks for more than a year, focusing on capital appreciation and dividends. Conversely, short-term traders may hold stocks for a few days or weeks, aiming to capitalize on short-term price fluctuations.

Market Sentiment: The average holding period can also indicate market sentiment. For instance, a rising average holding period may suggest that investors are becoming more bullish and holding onto stocks for longer periods.

Market Efficiency: The average holding period can also be used to gauge market efficiency. If the average holding period is short, it may indicate that the market is efficient, with prices quickly reflecting all available information.

Average Holding Period in the US

The average holding period for stocks in the US has been fluctuating over the years. According to a study by The Wall Street Journal, the average holding period for stocks in the US was around 7.6 years in 2019. However, this figure has been decreasing over the years, suggesting a shift towards more short-term trading strategies.

Factors Influencing the Average Holding Period

Several factors influence the average holding period for stocks in the US:

Market Conditions: During bull markets, investors tend to hold onto stocks for longer periods, expecting higher returns. Conversely, during bear markets, investors may sell off stocks quickly to minimize losses.

Investor Sentiment: Market sentiment plays a crucial role in determining the average holding period. For instance, during periods of uncertainty, investors may hold onto stocks for shorter periods.

Technological Advancements: The rise of online trading platforms and mobile applications has made it easier for investors to trade stocks, leading to shorter holding periods.

Case Studies

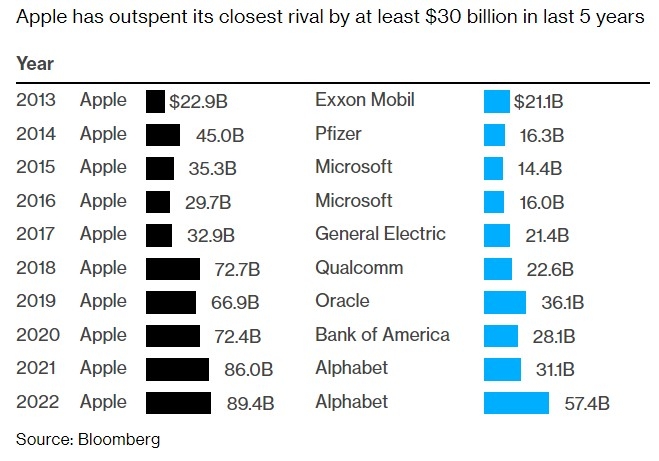

Tech Stocks: Tech stocks, such as Apple and Microsoft, have traditionally had longer holding periods. However, in recent years, these stocks have seen shorter holding periods due to increased volatility and speculative trading.

Small-Cap Stocks: Small-cap stocks often have shorter holding periods compared to large-cap stocks. This is because small-cap stocks are more volatile and subject to speculative trading.

Conclusion

The average holding period for stocks in the US is a crucial metric that reflects investment strategies, market sentiment, and market efficiency. Understanding this metric can help investors make informed decisions and adapt their strategies accordingly.

NYSE Composite