In the vast world of investment opportunities, US stocks have long been a cornerstone for investors seeking growth and stability. Among the numerous investment firms, BlackRock stands out as a global leader in financial management. This article delves into the world of BlackRock US stocks, providing valuable insights for investors looking to diversify their portfolios.

Understanding BlackRock

BlackRock is a prominent investment management firm founded in 1985. With a strong presence in the United States and worldwide, it manages assets worth over $8 trillion. The company offers a wide range of investment solutions, including mutual funds, exchange-traded funds (ETFs), and private equity.

Why Invest in BlackRock US Stocks?

Diversification: BlackRock provides a diverse range of US stocks, enabling investors to spread their investments across various sectors and industries. This diversification helps mitigate risk and maximize returns.

Professional Management: BlackRock boasts a team of experienced professionals who are well-versed in the US stock market. Their expertise ensures that investors receive the best possible advice and guidance.

Access to High-Performing Stocks: BlackRock has a proven track record of identifying and investing in high-performing stocks. This can lead to significant returns for investors.

Innovative Investment Strategies: BlackRock employs innovative investment strategies that help investors stay ahead of the market. Their use of advanced analytics and technology ensures that investors have access to the latest market trends and insights.

Key BlackRock US Stock ETFs

BlackRock offers a variety of ETFs that focus on US stocks. Some notable examples include:

iShares Core U.S. Aggregate Bond ETF (AGG): This ETF provides exposure to a broad range of U.S. investment-grade bonds, offering investors a diversified and low-cost way to invest in the U.S. bond market.

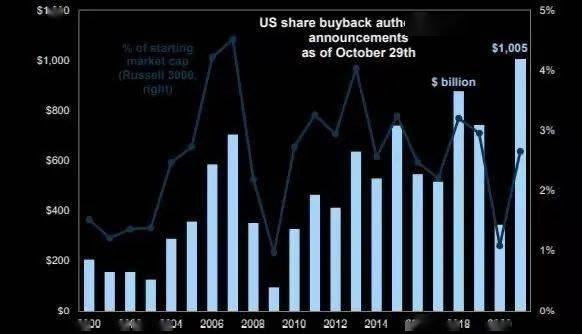

iShares Core U.S. ETF (IUSB): This ETF tracks the performance of the Russell 3000 Index, which represents the largest 3,000 U.S. companies. It offers investors a comprehensive exposure to the U.S. stock market.

iShares Edge MSCI USA Quality Factor ETF (QUAL): This ETF focuses on companies with strong fundamentals, such as high returns on equity, stable earnings, and low financial leverage. It aims to provide investors with quality stocks that may outperform the broader market.

Case Studies

Apple Inc. (AAPL): BlackRock has been a significant investor in Apple Inc. for years. Its ETFs have provided investors with exposure to this high-performing stock, leading to substantial returns.

Microsoft Corporation (MSFT): BlackRock has also been a significant investor in Microsoft, another high-performing stock. Its ETFs have helped investors capitalize on the company's growth and profitability.

Conclusion

Investing in BlackRock US stocks can be a wise decision for investors looking to diversify their portfolios. With professional management, access to high-performing stocks, and innovative investment strategies, BlackRock offers a compelling option for those seeking to maximize their returns.

NYSE Composite