In the vast world of investment, finding the right portfolio can be a daunting task. However, with BlackRock's Total US Stock Market Fund, investors can gain access to a diverse and comprehensive portfolio that aims to deliver long-term growth. This article delves into the details of this fund, highlighting its key features and benefits.

What is BlackRock Total US Stock Market?

BlackRock Total US Stock Market is an index fund that tracks the performance of the entire U.S. stock market. It provides investors with exposure to a wide range of stocks, including those from large, mid-sized, and small companies across various sectors. By investing in this fund, investors can gain access to the broader market's growth potential without having to manually select individual stocks.

Key Features of BlackRock Total US Stock Market

1. Diversification: One of the primary benefits of the BlackRock Total US Stock Market Fund is its diversification. By investing in a broad range of stocks, the fund helps to reduce the risk associated with investing in a single stock or sector. This diversification is particularly beneficial during market downturns, as the performance of the fund is less likely to be negatively impacted by the poor performance of a few individual companies.

2. Low Fees: BlackRock is known for its competitive fees, and the Total US Stock Market Fund is no exception. The fund has a low expense ratio, which means that a smaller portion of your investment is used to pay for fund management and administrative costs. This can help to maximize your returns over time.

3. Easy Access: Investing in the BlackRock Total US Stock Market Fund is straightforward. You can purchase shares through a brokerage account or directly from BlackRock. The fund is also available through many retirement accounts, making it a convenient option for investors looking to build their nest egg.

4. Tax Efficiency: The BlackRock Total US Stock Market Fund is a passively managed index fund, which means that it does not generate capital gains distributions. This can be beneficial for investors looking to minimize their tax burden, as they will not have to pay taxes on capital gains until they sell their shares.

Case Study:

Consider an investor who invested

Conclusion:

The BlackRock Total US Stock Market Fund is an excellent option for investors looking to gain exposure to the broader U.S. stock market while enjoying the benefits of diversification, low fees, and tax efficiency. By investing in this fund, you can potentially benefit from the long-term growth of the U.S. economy and the stock market.

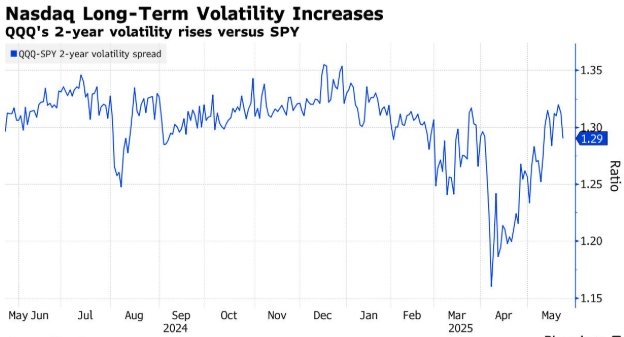

NASDAQ Composite