The Dow Jones Industrial Average (DJIA), often simply referred to as the "Dow," has been a barometer of the U.S. stock market for over a century. However, as of late, investors have been questioning why the Dow Jones is down. This article delves into the various factors contributing to the downward trend, offering a comprehensive analysis to shed light on this market phenomenon.

Economic Indicators and Inflation Concerns

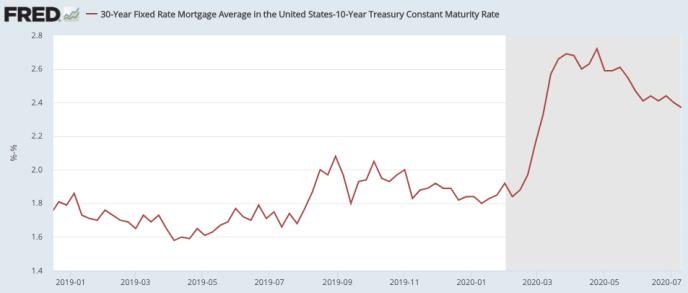

One of the primary reasons for the Dow Jones' decline is the increasing concern over economic indicators and inflation. The Federal Reserve has been raising interest rates to combat inflation, which has been on the rise due to factors such as supply chain disruptions and increased demand. As interest rates rise, borrowing costs increase, which can lead to reduced consumer spending and investment, ultimately affecting the stock market.

Geopolitical Tensions and Global Economic Uncertainty

Geopolitical tensions and global economic uncertainty have also played a significant role in the Dow Jones' downward trend. The ongoing conflict in Eastern Europe and the tensions between major economies have raised concerns about global stability and economic growth. These uncertainties have led to increased volatility in the stock market, with investors selling off stocks in anticipation of potential downturns.

Corporate Earnings Reports

Another factor contributing to the Dow Jones' decline is the release of corporate earnings reports. Many companies have reported lower-than-expected earnings, which have led to a sell-off in their stocks. This has had a cascading effect on the broader market, causing the Dow Jones to fall.

Technological Advances and Market Sentiment

Technological advances and market sentiment have also played a role in the Dow Jones' downward trend. As companies invest in new technologies and innovations, they may experience temporary disruptions in their operations, leading to lower earnings and stock prices. Additionally, market sentiment can be swayed by various factors, such as economic news, political events, and consumer confidence.

Case Study: The Impact of the COVID-19 Pandemic

One of the most significant events that caused the Dow Jones to plummet was the COVID-19 pandemic. As the virus spread across the globe, governments implemented lockdowns and travel restrictions, leading to a sharp decline in economic activity. This, in turn, caused the Dow Jones to fall by nearly 35% from its all-time high in February 2020 to its lowest point in March 2020.

Conclusion

The Dow Jones' downward trend can be attributed to a combination of economic indicators, geopolitical tensions, corporate earnings reports, technological advances, and market sentiment. While the market may continue to face challenges, it's important for investors to remain vigilant and stay informed about the various factors influencing the stock market. By understanding these factors, investors can make more informed decisions and navigate the market with greater confidence.

Index Fund