Activity(2)Unusual(4)Options(5)Stock(13053)

In the dynamic world of stock trading, unusual options activity can often signal significant market movements or investor sentiment shifts. Today, we're diving into the unusual options activity surrounding US stocks to provide you with insights into what could be brewing in the market.

Understanding Unusual Options Activity

First, let's clarify what unusual options activity entails. It refers to the purchase or sale of a large number of options contracts for a particular stock or index within a short period. This activity can be indicative of several factors, including institutional interest, potential earnings announcements, or a significant market event.

Key Stocks with Unusual Options Activity

Apple Inc. (AAPL): One of the most significant names in tech, Apple, has seen a surge in unusual options activity. Traders are betting on a potential rise in the stock, possibly in anticipation of its next product launch or financial results.

Tesla Inc. (TSLA): Another tech giant, Tesla, has also seen a rise in unusual options activity. The focus seems to be on its battery production and autonomous driving capabilities, which could impact the company's future earnings.

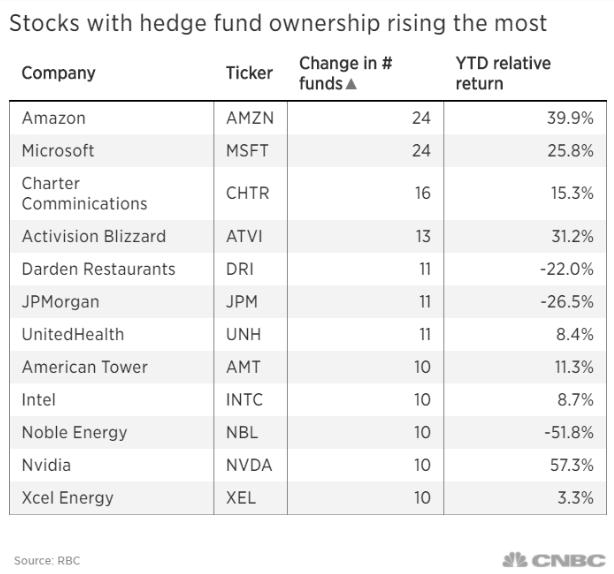

NVIDIA Corporation (NVDA): The demand for graphics processing units (GPUs) has surged, leading to increased activity in NVIDIA's options. Investors are likely considering the company's position in the AI and gaming sectors.

Analyzing the Trends

The unusual options activity in these stocks reflects a broader trend in the market. Investors are increasingly turning to options as a way to manage risk and capitalize on potential market movements.

Call Options: These are contracts that give the buyer the right to purchase the underlying asset at a specific price within a specific period. The surge in call options for Apple and Tesla suggests that investors are bullish on these companies.

Put Options: Conversely, put options are contracts that give the buyer the right to sell the underlying asset at a specific price within a specific period. The unusual options activity in NVIDIA suggests that some investors are considering the possibility of a decline in the stock's price.

Case Study: Microsoft Corporation (MSFT)

A prime example of unusual options activity is seen in Microsoft. In the days leading up to its quarterly earnings announcement, the company saw a significant increase in put options. This activity indicated that investors were anticipating a potential decline in the stock's price if the earnings report was less than expected.

Conclusion

Unusual options activity in US stocks today offers a glimpse into the market's sentiment and potential future movements. As always, it's important for investors to conduct thorough research and consult with a financial advisor before making any investment decisions.

Dow Jones