Sentiment(2)Market(808)Today(120)Stock(13053)T(256)

In the fast-paced world of finance, staying abreast of the latest market sentiment is crucial for investors and traders. Today, we delve into the current sentiment in the US stock market, exploring what’s driving investors’ decisions and where the market may be heading.

Understanding Market Sentiment

Market sentiment refers to the overall attitude of investors towards the market. It can be bullish (positive), bearish (negative), or neutral. Sentiment can be influenced by a variety of factors, including economic indicators, corporate earnings reports, geopolitical events, and technological advancements.

Current Market Sentiment in the US Stock Market

As of today, the US stock market sentiment is cautiously bullish. This sentiment is driven by several key factors:

- Strong Economic Indicators: The US economy has been growing at a steady pace, with low unemployment rates and strong consumer spending. This positive economic backdrop has supported the stock market.

- Corporate Earnings: Many companies have reported strong earnings, fueling investor confidence and contributing to a bullish market sentiment.

- Interest Rates: The Federal Reserve has signaled a slower pace of interest rate hikes, which has been seen as a positive sign for the stock market.

Case Study: Technology Stocks

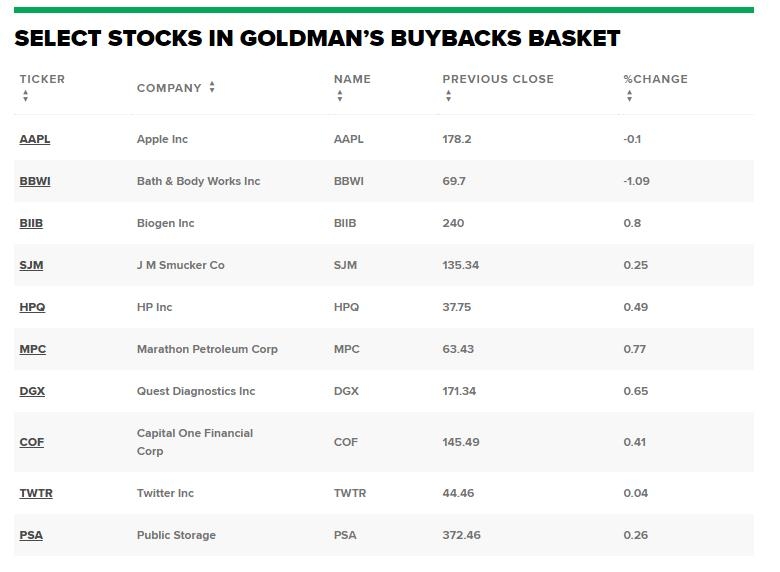

One sector that has been particularly influential in shaping the current market sentiment is the technology sector. Tech stocks have been leading the charge, with giants like Apple, Microsoft, and Amazon posting impressive growth.

- Apple: The tech giant has seen a significant surge in its stock price, driven by strong sales of its iPhones and services.

- Microsoft: The software company has been a steady performer, with its cloud computing and business services divisions contributing to its growth.

- Amazon: The e-commerce giant has been expanding into new areas, such as cloud computing and healthcare, which has helped to drive its stock price higher.

What to Watch For

While the current market sentiment is bullish, there are several factors that investors should keep an eye on:

- Global Economic Conditions: Geopolitical tensions and economic uncertainty in other parts of the world could impact the US stock market.

- Corporate Earnings: Companies will continue to report earnings, and any negative surprises could dampen investor confidence.

- Technological Advancements: New technologies and innovations could disrupt existing sectors and impact the stock market.

Conclusion

In conclusion, the current market sentiment in the US stock market is cautiously bullish. While there are risks to consider, the overall outlook remains positive. As always, it’s important for investors to stay informed and make well-informed decisions based on their individual investment goals and risk tolerance.

Dow Jones