In the ever-evolving world of investments, preferred stocks have gained significant popularity among investors seeking steady income and lower risk compared to common stocks. One of the most sought-after preferred stock ETFs is the iShares U.S. Preferred Stock ETF (symbol: PFF). This article delves into the details of the iShares US Preferred Stock Dividend, offering valuable insights for investors looking to maximize their returns.

What is iShares US Preferred Stock Dividend?

The iShares U.S. Preferred Stock Dividend ETF is designed to track the performance of a basket of preferred stocks listed on U.S. exchanges. This ETF provides investors with exposure to the preferred stock market, allowing them to benefit from the attractive yields and stability offered by preferred stocks.

Key Features of iShares US Preferred Stock Dividend

Dividend Yield: One of the primary attractions of preferred stocks is their high dividend yield. The iShares US Preferred Stock Dividend ETF aims to deliver a substantial dividend yield, which can be a significant source of income for investors.

Stability: Preferred stocks are often considered a safer investment compared to common stocks, as they have a higher claim on a company's assets and earnings. The iShares ETF is designed to provide stability and lower volatility, making it an ideal investment for risk-averse investors.

Diversification: The ETF tracks a diversified portfolio of preferred stocks, reducing the risk associated with investing in a single stock. This diversification helps to mitigate the impact of market fluctuations and individual company performance.

Liquidity: The iShares US Preferred Stock Dividend ETF is highly liquid, allowing investors to buy and sell shares with ease. This liquidity makes it a convenient investment option for those looking to trade actively or for those who may need to access their investments quickly.

How Does the iShares US Preferred Stock Dividend Work?

When you invest in the iShares US Preferred Stock Dividend ETF, you are essentially purchasing a share of the ETF itself. This share represents your ownership stake in the basket of preferred stocks held by the ETF. As the preferred stocks within the ETF pay dividends, these dividends are distributed to the ETF shareholders.

Why Invest in the iShares US Preferred Stock Dividend?

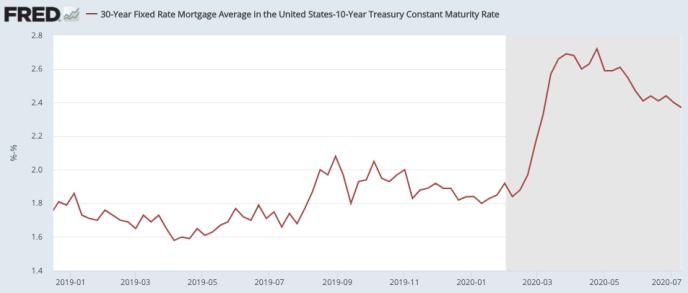

Income Generation: The high dividend yield offered by the iShares US Preferred Stock Dividend ETF makes it an excellent choice for investors seeking income in a low-interest-rate environment.

Stability: The ETF's focus on preferred stocks provides stability and lower risk, making it an ideal investment for conservative investors.

Diversification: The ETF's diversified portfolio helps to reduce the risk associated with investing in a single stock, making it a safer investment option.

Liquidity: The ETF's high liquidity makes it an easy investment to trade, allowing investors to buy and sell shares with ease.

Case Study: ABC Corp.

Let's consider a hypothetical scenario involving ABC Corp., a company that has issued preferred stocks. By investing in the iShares US Preferred Stock Dividend ETF, investors gain exposure to ABC Corp.'s preferred stocks. As ABC Corp. pays dividends on its preferred stocks, these dividends are distributed to the ETF shareholders, providing them with a steady stream of income.

In conclusion, the iShares US Preferred Stock Dividend ETF is an excellent investment option for those seeking income, stability, and diversification. By understanding the key features and benefits of this ETF, investors can make informed decisions and maximize their returns.

Dow Jones