Picks(65)2(24)Stocks(1515)Buy(324)For(175)TOP(489)the(2086)

In a volatile market, identifying the right stocks to buy can be challenging. However, with careful analysis and a keen eye for emerging trends, investors can make informed decisions. This article highlights some of the top stocks to consider in the US for 2023, providing a mix of established players and promising newcomers.

1. Technology Sector: The tech sector continues to dominate the market, with companies pushing the boundaries of innovation. Apple Inc. (AAPL) remains a solid investment, known for its consistent growth and market leadership. Its ecosystem of products and services ensures a steady revenue stream. Additionally, Amazon.com Inc. (AMZN) is another tech giant worth considering, with its diverse portfolio of offerings ranging from e-commerce to cloud computing.

2. Healthcare Sector: The healthcare sector is poised for significant growth, driven by an aging population and technological advancements. Johnson & Johnson (JNJ) is a well-regarded pharmaceutical and consumer healthcare company with a strong presence in both sectors. Moderna Inc. (MRNA), on the other hand, has gained traction for its role in developing the COVID-19 vaccine, showcasing its potential for future success.

3. Consumer Goods: Consumer goods companies often offer stability and consistent returns. Procter & Gamble Co. (PG) is a household name, producing a wide range of consumer products. Coca-Cola Co. (KO) is another top pick, with its robust global brand and diversified product line.

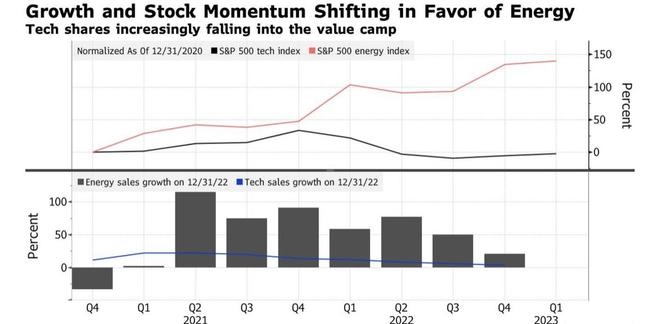

4. Energy Sector: The energy sector presents opportunities for those looking to invest in long-term growth. Exxon Mobil Corp. (XOM) is a leader in the oil and gas industry, offering a blend of dividend yield and potential for capital gains. Chevron Corp. (CVX) is another strong contender, with its focus on renewable energy projects.

5. Financial Sector: The financial sector is often considered a safe haven during market uncertainty. JPMorgan Chase & Co. (JPM) is a financial powerhouse, providing a range of services from investment banking to consumer lending. Wells Fargo & Co. (WFC) has been rebuilding its reputation and offers a strong dividend yield.

Case Study: Let's take a closer look at Tesla Inc. (TSLA), a leading player in the electric vehicle (EV) market. Despite facing challenges and market skepticism, Tesla has seen remarkable growth. Its innovative approach to EV technology and expansion into new markets like solar energy and battery storage have positioned it as a key player in the future of transportation.

In conclusion, investing in the US market requires a well-diversified portfolio. By focusing on sectors with strong growth potential, such as technology, healthcare, consumer goods, energy, and financials, investors can make informed decisions and potentially achieve significant returns. Always remember to conduct thorough research and consider your investment goals and risk tolerance before making any investment decisions.

Dow Jones