Earnings(15)Recent(21)Momentum(290)Stock(13053)

In the ever-evolving world of the stock market, investors are always on the lookout for the next big thing. One of the most effective ways to identify potential winners is by focusing on stocks with strong earnings momentum. In this article, we will explore some of the recent US earnings momentum stocks that have caught the attention of investors and financial analysts alike.

Understanding Earnings Momentum

Earnings momentum refers to the trend of a company's earnings growth. It is a critical indicator for investors looking to identify stocks with strong potential for future gains. Companies with positive earnings momentum tend to outperform the market over the long term.

Recent US Earnings Momentum Stocks

- Apple Inc. (AAPL)

Apple, the world's largest technology company, has been a leader in earnings momentum for several years. The company's strong performance in the smartphone, services, and wearables segments has driven its earnings growth. With a market capitalization of over $2 trillion, Apple continues to be a top pick for investors seeking strong earnings momentum.

- Microsoft Corporation (MSFT)

Microsoft, another tech giant, has also been a strong performer in terms of earnings momentum. The company's cloud computing business, particularly its Azure platform, has been a significant driver of its earnings growth. Microsoft's diversified revenue streams and strong financial position make it a compelling investment opportunity for those looking to capitalize on earnings momentum.

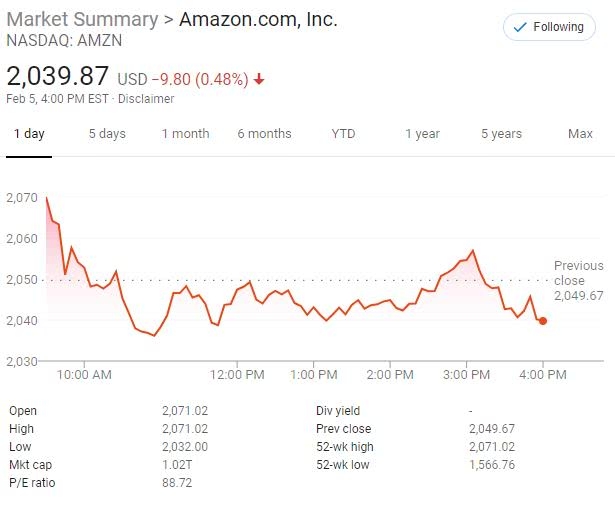

- Amazon.com, Inc. (AMZN)

Amazon, the e-commerce and cloud computing behemoth, has been a major force in the stock market. Despite facing headwinds from the pandemic, the company has continued to grow its earnings. Amazon's Prime membership program and cloud computing business, Amazon Web Services (AWS), have been key drivers of its earnings momentum.

- Tesla, Inc. (TSLA)

Tesla, the electric vehicle (EV) manufacturer, has been a standout performer in recent years. The company's rapid growth in vehicle sales and expansion into new markets have driven its earnings momentum. With a focus on innovation and sustainability, Tesla remains a top pick for investors looking to capitalize on earnings momentum.

- NVIDIA Corporation (NVDA)

NVIDIA, a leader in graphics processing units (GPUs), has been a significant driver of earnings momentum. The company's strong performance in the gaming, data center, and automotive markets has fueled its growth. NVIDIA's continued innovation and expansion into new markets make it a compelling investment opportunity.

Case Studies

To illustrate the potential of earnings momentum stocks, let's take a look at two case studies:

- Apple Inc. (AAPL)

In the past five years, Apple's earnings per share (EPS) has grown at an average annual rate of 12%. During this period, the company's stock price has appreciated by over 50%. This demonstrates the power of earnings momentum and how it can drive significant returns for investors.

- Tesla, Inc. (TSLA)

Tesla's EPS has grown at an average annual rate of 60% over the past five years. During this period, the company's stock price has surged by over 1,000%. This case study highlights the potential of earnings momentum stocks and how they can generate substantial returns for investors.

Conclusion

In conclusion, recent US earnings momentum stocks offer investors a unique opportunity to capitalize on the strong performance of companies with positive earnings trends. By focusing on companies like Apple, Microsoft, Amazon, Tesla, and NVIDIA, investors can potentially achieve significant returns. However, it is crucial to conduct thorough research and analysis before making any investment decisions.

Dow Jones