BNPL(2)Consume(1)Stocks(1515)Future(73)the(2086)

In recent years, Buy Now, Pay Later (BNPL) has emerged as a revolutionary trend in the consumer finance industry. This innovative payment model allows customers to purchase goods and services immediately and pay for them over time, typically with no interest or fees. The rise of BNPL stocks in the US has been nothing short of spectacular, and this article delves into the reasons behind this surge and the potential future of this burgeoning sector.

Understanding BNPL Stocks

BNPL stocks refer to the shares of companies that operate in the BNPL space. These companies provide consumers with the ability to pay for purchases in installments, often without interest or fees. Some of the most prominent BNPL stocks in the US include Afterpay (APT), Affirm (AFRM), and Klarna (KRA).

The Growth of BNPL Stocks

The growth of BNPL stocks can be attributed to several factors. Firstly, the convenience and flexibility offered by BNPL solutions have resonated with consumers, particularly younger demographics. According to a study by Insider Intelligence, the number of BNPL users in the US is expected to reach 52.5 million by 2025, up from 28.5 million in 2021.

Secondly, the COVID-19 pandemic accelerated the shift towards online shopping, which in turn fueled the demand for BNPL solutions. Many consumers found themselves with limited access to credit cards or other traditional financing options, making BNPL an attractive alternative.

The Impact of BNPL Stocks on the Consumer Finance Industry

The rise of BNPL stocks has had a significant impact on the consumer finance industry. Traditional credit card companies and banks have been forced to adapt to the changing landscape, offering their own BNPL solutions to stay competitive. This competition has led to increased innovation and better customer experiences.

Case Studies: Success Stories in BNPL Stocks

One of the most successful BNPL stocks is Afterpay, which has seen its share price skyrocket since its IPO in 2015. Afterpay's partnership with major retailers like Target and Walmart has helped it gain a significant market share in the US.

Another standout example is Affirm, which has secured partnerships with brands like Nike and Peloton. Affirm's focus on transparency and responsible lending practices has helped it build a strong reputation in the industry.

The Future of BNPL Stocks

The future of BNPL stocks in the US looks promising. As more consumers embrace digital payments and seek alternative financing options, BNPL solutions are expected to become even more prevalent. However, there are challenges ahead, including regulatory scrutiny and the need to ensure responsible lending practices.

In conclusion, BNPL stocks have become a significant force in the consumer finance industry, driven by the convenience and flexibility they offer to consumers. As the market continues to evolve, it will be interesting to see how BNPL stocks adapt and grow in the years to come.

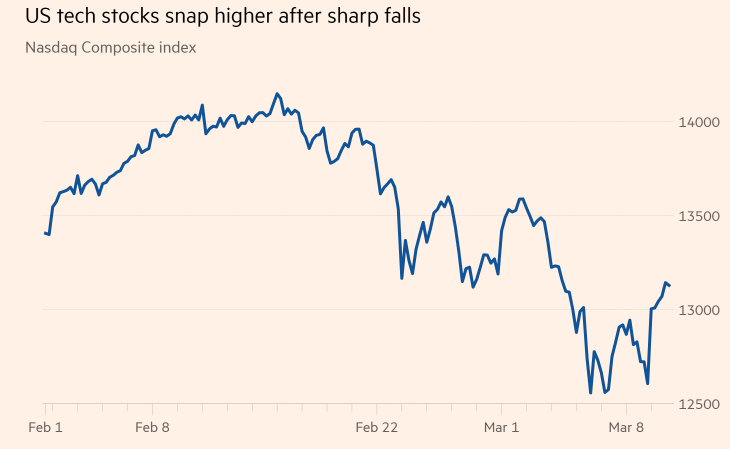

Dow Jones