In the ever-evolving landscape of the global energy market, understanding the total US oil stock is crucial for investors, policymakers, and consumers alike. This article delves into the current status of the US oil stock, its impact on the market, and what the future might hold for this vital resource.

Current Status of Total US Oil Stock

The United States has been a leading producer of oil for decades, and its total oil stock has seen significant fluctuations over the years. As of the latest data, the total US oil stock stands at approximately 6.7 billion barrels. This figure includes both crude oil and refined products, such as gasoline and diesel.

The US oil stock is influenced by various factors, including production levels, imports, and exports. Over the past few years, the US has seen a surge in domestic oil production, primarily driven by advancements in hydraulic fracturing and horizontal drilling techniques. This has helped the country reduce its reliance on imported oil and become a net exporter.

Impact of Total US Oil Stock on the Market

The total US oil stock plays a crucial role in the global oil market. When the stock is high, it tends to put downward pressure on oil prices, as there is an abundance of supply. Conversely, when the stock is low, prices tend to rise due to concerns about supply shortages.

In recent years, the US has become a major player in the global oil market, with its oil stock often being a key factor in determining global oil prices. For instance, during the COVID-19 pandemic, when global oil demand plummeted, the US was able to maintain its oil stock, helping to stabilize the market.

Future Projections for Total US Oil Stock

Looking ahead, the future of the total US oil stock is subject to various factors, including technological advancements, geopolitical events, and changes in global oil demand. Here are some key projections:

- Increased Production: With advancements in technology, the US is expected to continue increasing its oil production. This could lead to a higher total oil stock in the coming years.

- Global Oil Demand: As the world transitions to cleaner energy sources, the demand for oil may decline. However, the US may still see a steady demand for its oil, both domestically and internationally.

- Geopolitical Events: Political instability in oil-producing countries can impact global oil supply and, consequently, the total US oil stock. The US, being a major oil producer itself, may be less affected by such events compared to other countries.

Case Study: The Impact of US Oil Stock on Global Oil Prices

One notable case study is the 2014 oil price crash. At that time, the US oil stock was at an all-time high, leading to downward pressure on global oil prices. This situation had a significant impact on oil-producing countries, some of which faced economic hardships.

In conclusion, the total US oil stock is a vital indicator of the global oil market. Understanding its current status and future projections can help stakeholders make informed decisions. As the US continues to be a major player in the global oil market, its total oil stock will remain a key factor to watch.

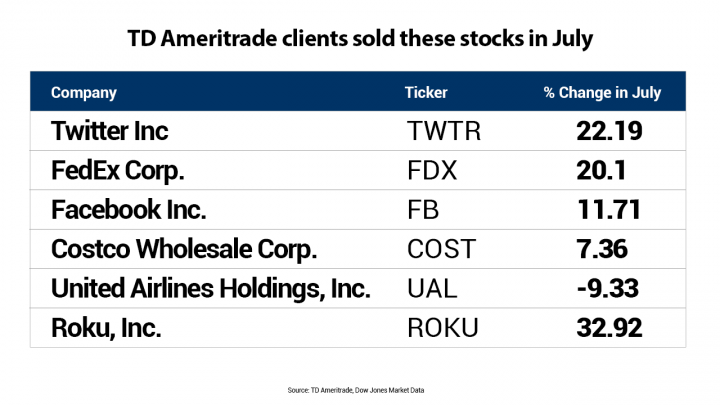

American stock trading