The US housing stock value is a crucial factor in understanding the real estate market's health and potential for growth. As the largest asset class in the United States, residential properties play a significant role in the nation's economy. This article delves into the factors that influence the value of the US housing stock, its current trends, and potential future developments.

Understanding the US Housing Stock

The US housing stock refers to the total number of residential properties in the country, including single-family homes, multi-family units, and condominiums. These properties are valued based on several factors, such as location, age, condition, and market demand.

Location, Location, Location

One of the most critical factors affecting the value of the US housing stock is location. Properties in desirable neighborhoods with access to amenities, good schools, and transportation are typically more valuable. For example, homes in cities like San Francisco, New York, and Boston often command higher prices due to their prime locations.

Age and Condition

The age and condition of a property also play a significant role in determining its value. Older homes may require more maintenance and repairs, which can decrease their value. Conversely, well-maintained homes, especially those with modern upgrades, tend to be more valuable.

Market Demand

Market demand is another crucial factor influencing the value of the US housing stock. When there is high demand for housing in a particular area, prices tend to rise. Conversely, a surplus of available properties can lead to falling prices.

Current Trends in the US Housing Stock Value

The US housing stock value has been on the rise in recent years, driven by factors such as population growth, low interest rates, and a recovering economy. However, there are some notable trends to keep an eye on:

- Rising Home Prices: The median home price in the United States has been increasing steadily over the past few years, with some regions experiencing double-digit growth.

- Housing Affordability: Despite rising prices, housing affordability remains a significant concern for many Americans. High prices and rising interest rates have made it increasingly difficult for first-time buyers to enter the market.

- Urbanization: The trend of urbanization continues to drive demand for housing in cities and urban areas, leading to higher prices in these regions.

Case Study: The Housing Market in San Francisco

San Francisco is often cited as an example of the extreme growth in the US housing stock value. The city's prime location, high demand, and limited supply have driven home prices to astronomical levels. In 2021, the median home price in San Francisco reached $1.7 million, making it one of the most expensive housing markets in the country.

Conclusion

Understanding the US housing stock value is essential for anyone interested in real estate investment or the broader economy. By considering factors such as location, age, condition, and market demand, investors and homeowners can make informed decisions about their properties. As the real estate market continues to evolve, staying informed about the factors that influence the value of the US housing stock is more important than ever.

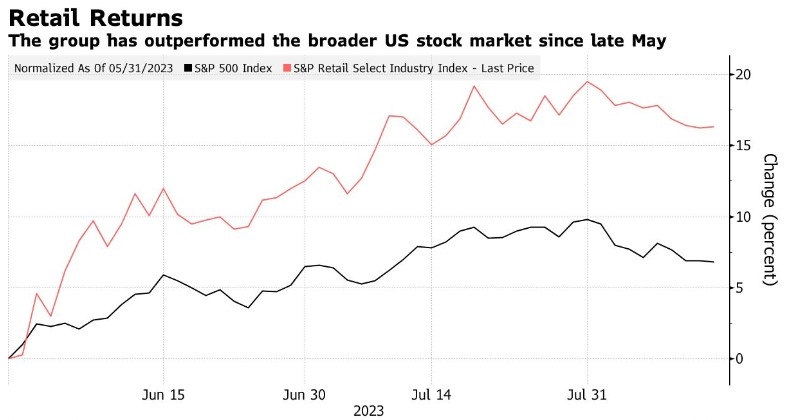

American stock news