In the ever-evolving landscape of the stock market, investors are constantly on the lookout for opportunities that offer both stability and substantial growth potential. One such category is high growth large cap US stocks. These companies, with market capitalizations of over $10 billion, have a proven track record of success and are poised for significant expansion. In this article, we will delve into the characteristics of these stocks, their advantages, and some notable examples that have captured the attention of investors worldwide.

Understanding High Growth Large Cap US Stocks

High growth large cap US stocks are defined by their impressive financial performance and potential for future expansion. These companies are typically leaders in their respective industries, with strong market positions and substantial revenue streams. While large cap stocks are known for their stability, high growth companies offer the added allure of significant upside potential.

Key Characteristics of High Growth Large Cap US Stocks

- Solid Financial Performance: These companies have a strong financial foundation, with consistent revenue growth, healthy profit margins, and a robust balance sheet.

- Innovative Business Models: High growth large cap stocks often have innovative business models that set them apart from their competitors and drive their success.

- Strong Management: These companies are typically led by experienced and visionary leaders who are committed to driving growth and creating long-term value.

- Expanding Market Opportunities: High growth large cap stocks are often in industries with significant growth potential, allowing them to capitalize on new market trends and opportunities.

Advantages of Investing in High Growth Large Cap US Stocks

- Stability: Large cap stocks are generally less volatile than smaller companies, providing investors with a sense of security.

- Dividends: Many high growth large cap stocks pay dividends, offering investors a stream of income.

- Market Leadership: Investing in these companies allows investors to gain exposure to market leaders in their respective industries.

- Long-Term Growth Potential: High growth large cap stocks have the potential to deliver significant returns over the long term.

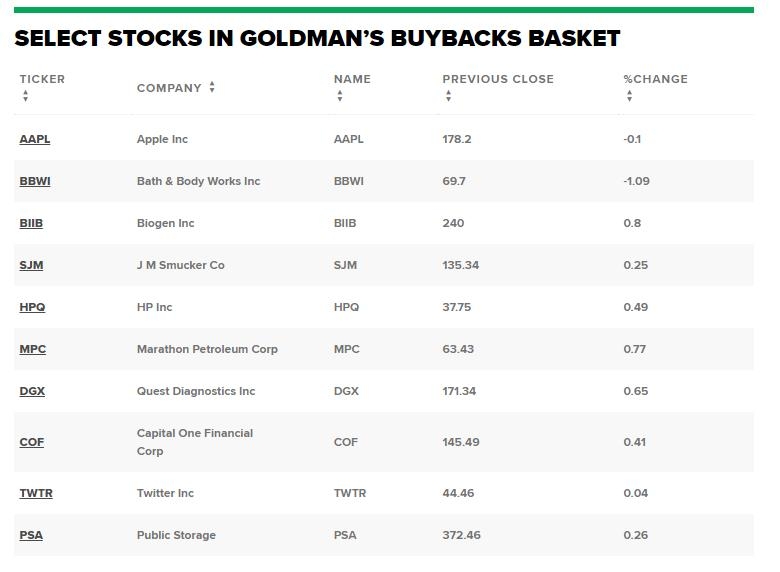

Notable Examples of High Growth Large Cap US Stocks

- Apple Inc. (AAPL): As the world's largest technology company, Apple has a market capitalization of over $2 trillion. The company's innovative products, strong brand, and commitment to innovation have driven its impressive growth.

- Microsoft Corporation (MSFT): Microsoft, another tech giant, has a market capitalization of over $1.5 trillion. The company's diverse portfolio of products and services, including cloud computing and gaming, has contributed to its success.

- Amazon.com, Inc. (AMZN): With a market capitalization of over $1.4 trillion, Amazon has revolutionized the retail industry with its e-commerce platform and subscription services.

In conclusion, high growth large cap US stocks represent a compelling investment opportunity for investors seeking both stability and substantial growth potential. By understanding the characteristics and advantages of these stocks, investors can make informed decisions and potentially capitalize on the success of market leaders in their respective industries.

American stock news