Insights(15)Unlocking(261)500(23)the(2086)Sto(195)

Are you intrigued by the dynamic world of stock trading? Do you want to gain a deeper understanding of the US 500 stock chart? Look no further! In this comprehensive guide, we'll explore the key aspects of the US 500 stock chart, including its significance, components, and how to interpret it effectively. Whether you're a seasoned investor or a beginner, this article will equip you with the knowledge to navigate the stock market like a pro.

Understanding the US 500 Stock Chart

The US 500 stock chart is a visual representation of the performance of the 500 largest publicly traded companies in the United States. It's a crucial tool for investors and traders as it provides a quick overview of market trends and individual stock performance. By analyzing this chart, you can gain valuable insights into the overall health of the market and make informed investment decisions.

Key Components of the US 500 Stock Chart

Price and Volume: The most fundamental components of a stock chart are price and volume. Price indicates the current value of a stock, while volume reflects the number of shares being traded. Understanding these metrics helps you assess market demand and potential price movements.

Time Frame: The US 500 stock chart can be viewed in various time frames, such as intraday, daily, weekly, or monthly. Choosing the right time frame depends on your investment strategy. Short-term traders might prefer intraday charts, while long-term investors may opt for weekly or monthly charts.

Technical Indicators: Technical indicators are mathematical tools used to analyze past price and volume data to predict future market movements. Some popular indicators include moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence). Incorporating these indicators into your analysis can enhance your decision-making process.

Chart Patterns: Chart patterns are visual formations that indicate potential market movements. Common patterns include head and shoulders, triangles, and flags. Recognizing these patterns can help you anticipate price trends and enter or exit positions at optimal times.

How to Interpret the US 500 Stock Chart

Identify Trends: Look for trends in the stock chart, such as uptrends, downtrends, or sideways trends. Uptrends are characterized by higher highs and higher lows, while downtrends are marked by lower highs and lower lows. Sideways trends indicate a period of consolidation.

Analyze Support and Resistance: Support and resistance levels are critical price points where the stock has repeatedly struggled to move beyond. Traders often use these levels to determine entry and exit points.

Use Technical Indicators and Chart Patterns: Incorporate technical indicators and chart patterns into your analysis to gain a more accurate picture of the market. For example, a moving average crossover can signal a trend reversal, while a head and shoulders pattern may indicate a downward trend.

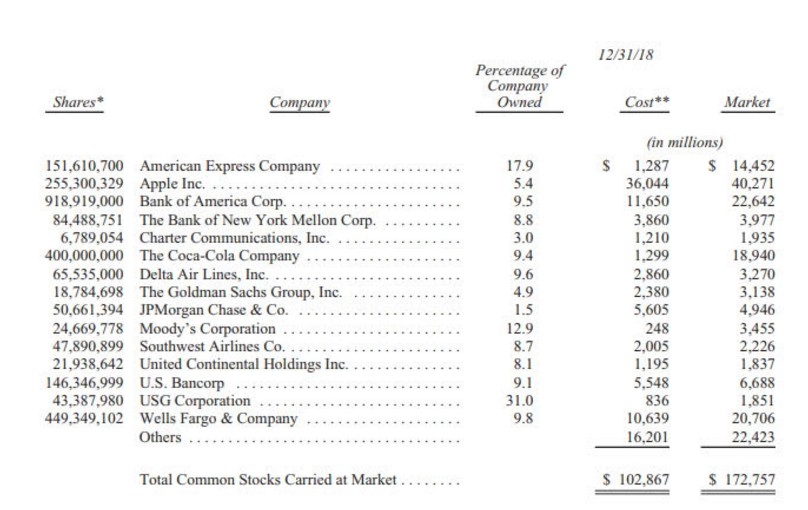

Case Study: Apple Inc. (AAPL)

Let's take a look at an example using Apple Inc. (AAPL), one of the components of the US 500. In the chart below, we can see a clear uptrend, with higher highs and higher lows. This indicates a strong buying momentum. Additionally, the chart shows a head and shoulders pattern, suggesting a potential reversal in the near future. By using technical indicators, we can confirm this pattern and make an informed decision.

In conclusion, the US 500 stock chart is a powerful tool for investors and traders. By understanding its key components and learning how to interpret it effectively, you can gain valuable insights into the stock market and make more informed investment decisions. Remember, the key to successful trading is knowledge, discipline, and patience.

American stock news