In the intricate world of finance, understanding the value of stocks is a cornerstone for investors and traders. It's more than just a number; it's a reflection of a company's worth and its potential for growth. This article delves into the key factors that determine stock value, offering insights that can help you make informed investment decisions.

What is Stock Value?

Stock value, simply put, is the worth of a company's shares on the market. It's determined by a variety of factors, including financial performance, market sentiment, and economic indicators. Understanding these factors is crucial for assessing the true value of stocks.

Key Factors Influencing Stock Value

Financial Performance

- Revenue: A company's revenue is a critical indicator of its financial health. Higher revenue often translates to higher stock value.

- Profitability: Companies with strong profitability are typically viewed as more valuable. Key metrics include net income and earnings per share (EPS).

- Earnings Growth: Consistent growth in earnings can significantly boost a stock's value.

Market Sentiment

- Sector Trends: Understanding the trends in your chosen sector can help you gauge the market sentiment towards a particular stock.

- Economic Indicators: Economic factors like interest rates, inflation, and GDP growth can influence market sentiment.

Valuation Ratios

- Price-to-Earnings (P/E) Ratio: This ratio compares a company's stock price to its EPS. A high P/E ratio may indicate overvaluation, while a low ratio might suggest undervaluation.

- Price-to-Book (P/B) Ratio: This ratio compares a company's stock price to its book value. A P/B ratio below 1 may suggest the stock is undervalued.

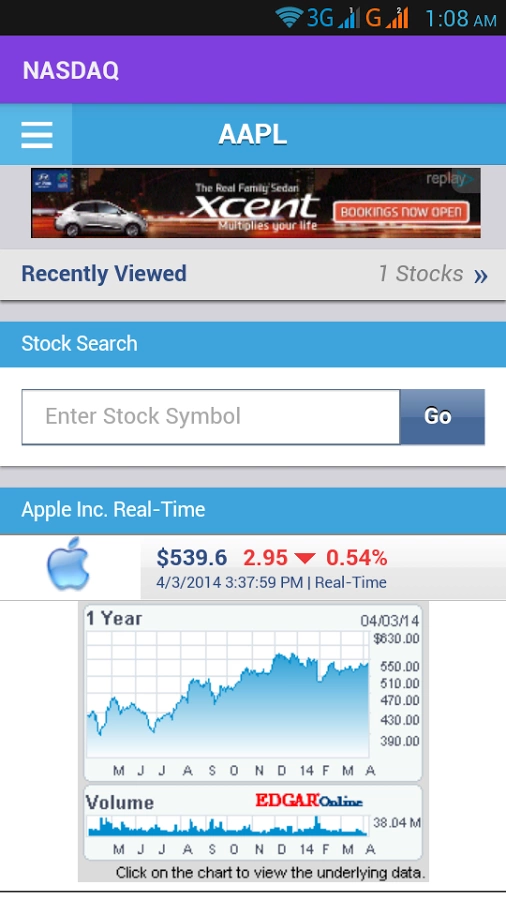

Case Study: Apple Inc.

Consider Apple Inc. (AAPL), a prime example of a stock with significant value. Over the years, Apple has demonstrated robust financial performance, consistently generating high revenue and profitability. This, combined with positive market sentiment, has driven its stock value up significantly.

Insights for Investors

- Diversification: Diversify your portfolio to reduce risk. Investing in various sectors and companies can help mitigate the impact of market volatility.

- Research: Conduct thorough research before investing. Analyze financial statements, read company reports, and stay informed about market trends.

- Long-term Perspective: Investing in stocks is often a long-term endeavor. Avoid getting swayed by short-term market fluctuations.

In conclusion, understanding the value of stocks involves analyzing various factors, including financial performance, market sentiment, and valuation ratios. By doing so, investors can make more informed decisions and potentially achieve higher returns. Remember, investing in stocks is a journey, and staying informed is key to navigating it successfully.

American stock news