In the fast-paced world of finance, understanding the number of stock trading days per year is crucial for investors and traders. This knowledge helps in planning and strategizing investments effectively. In this article, we will delve into the details of the US stock market trading days and how they impact investment decisions.

Understanding the US Stock Market

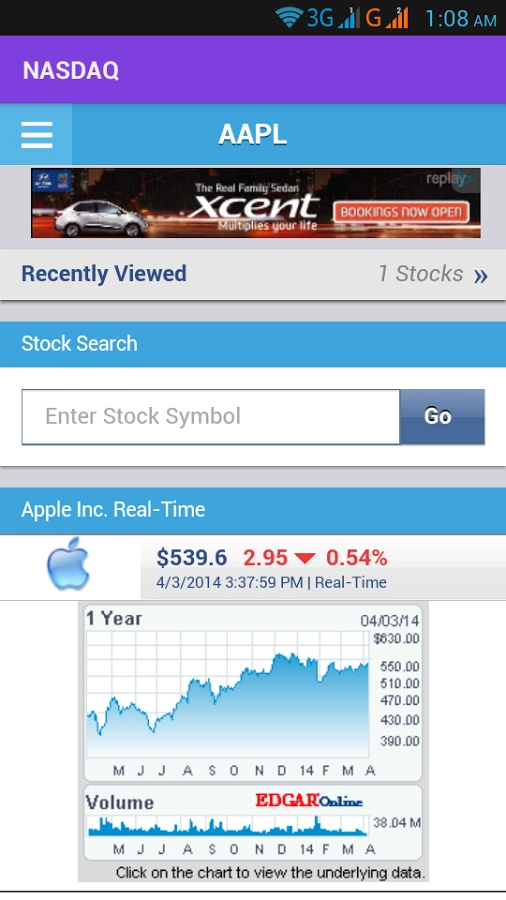

The US stock market is one of the largest and most influential in the world. It consists of various exchanges, including the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges facilitate the buying and selling of stocks, making it possible for investors to participate in the market.

Number of Trading Days

The US stock market operates on a five-day trading week, with two weekends and one federal holiday per month. However, the number of trading days in a year is not a simple multiplication of five days per week.

Regular Trading Days

There are typically 252 regular trading days in a year. This figure is derived by multiplying the number of trading days per week (5) by the number of weeks in a year (52). However, this calculation does not account for holidays and weekends.

Holidays and Weekends

Federal holidays and weekends significantly impact the number of trading days. In the US, there are approximately 10 federal holidays that affect stock market trading. These holidays include New Year's Day, Martin Luther King Jr. Day, President's Day, Memorial Day, Independence Day, Labor Day, Columbus Day, Thanksgiving Day, and Christmas Day.

When a federal holiday falls on a weekday, the market is closed for the day. Additionally, if a holiday falls on a weekend, the market may close on the nearest weekday. This can result in fewer trading days than the 252 regular trading days.

Impact on Investment Decisions

Understanding the number of trading days is crucial for investors and traders. It helps in planning investment strategies and managing portfolios effectively. For example, an investor may decide to allocate more capital during periods with a higher number of trading days to maximize returns.

Case Studies

To illustrate the impact of trading days on investment decisions, let's consider two case studies:

Case Study 1: An investor plans to buy a stock on the first trading day of the year. However, they forget to place the order due to a holiday. As a result, they miss out on potential gains during the first few trading days.

Case Study 2: A trader uses a seasonal trading strategy that involves buying stocks during the first two weeks of January. However, they fail to account for the number of trading days and end up losing money due to the reduced number of trading days in January.

Conclusion

In conclusion, the US stock market operates on approximately 252 regular trading days per year. However, the actual number of trading days can vary due to federal holidays and weekends. Understanding the number of trading days is crucial for investors and traders to make informed investment decisions and manage their portfolios effectively.

American stock news