The U.S. stock market has been a significant focal point for investors worldwide. With its volatility and potential for significant returns, many are left wondering: has the US stock market bottomed? This article delves into the factors that contribute to market bottoms, recent market trends, and expert opinions to provide a comprehensive analysis.

Market Dynamics and Historical Context

Understanding the concept of a market bottom requires a look at historical patterns. Market bottoms are typically characterized by extreme pessimism, high volatility, and significant price declines. Historically, market bottoms have been followed by strong recoveries and bull markets.

One of the most notable market bottoms in recent history occurred in March 2009, following the financial crisis of 2008. The S&P 500, a widely followed index, bottomed at 676.53 on March 6, 2009. From that point, the market experienced a robust recovery, with the S&P 500 nearly doubling in value over the next five years.

Current Market Trends

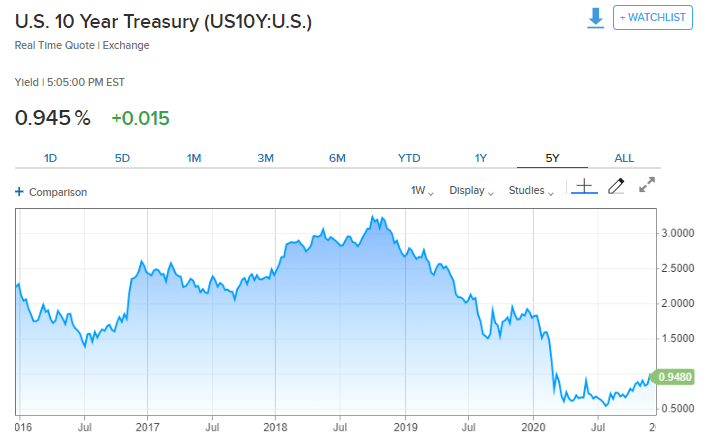

As of this writing, the U.S. stock market has experienced a significant downturn in 2022, with several factors contributing to the decline. Inflation, rising interest rates, and concerns about global economic growth have all played a role in the market's recent performance.

Despite these challenges, some analysts believe that the US stock market may have bottomed. Several indicators suggest that the market is approaching a bottom:

- Valuations: The S&P 500 is currently trading at a forward price-to-earnings (P/E) ratio of around 16, which is below its long-term average of around 18. This indicates that the market may be undervalued.

- Earnings Growth: Corporate earnings have been strong, with many companies reporting better-than-expected results. This suggests that the underlying fundamentals of the market are still robust.

- Market Breadth: The S&P 500 has seen a broad-based rally in recent weeks, with gains across various sectors. This indicates that the market is not just driven by a few high-flying stocks.

Expert Opinions

Several well-known experts have weighed in on whether the US stock market has bottomed:

- John Paulson: The renowned hedge fund manager and investor John Paulson has stated that he believes the US stock market has bottomed. He cited the strong earnings reports and undervalued market as reasons for his optimism.

- Larry Fink: The CEO of BlackRock, the world's largest asset manager, has also expressed optimism about the market's prospects. He noted that despite the challenges, the market has shown resilience and has the potential for a strong recovery.

Case Studies

To further understand the potential for a market bottom, let's look at a few recent examples:

- Tesla (TSLA): Despite facing significant regulatory challenges and concerns about its valuation, Tesla's stock has seen a significant rally in recent months, suggesting that the market may be bottoming out.

- Microsoft (MSFT): Microsoft has been a leader in the tech sector, reporting strong earnings and growing its revenue. Its stock has held up well during the market downturn, indicating potential resilience.

Conclusion

While it is impossible to predict the future with certainty, the current market conditions and expert opinions suggest that the US stock market may have bottomed. Investors should carefully consider their individual risk tolerance and investment goals before making decisions in the current market environment. As always, diversification and a long-term investment horizon are key principles to follow.

American stock news