Threatens(1)Fall(7)Trump(15)Stocks(1515)Ne(15)

In a stunning turn of events, the stock market in the United States has experienced a downturn as President Trump recently threatened to impose new tariffs on European Union (EU) countries. The news has sent shockwaves through the financial world, leading to a significant drop in stock prices across various sectors.

Background on Tariffs

Tariffs are essentially taxes imposed on imported goods. They are used to protect domestic industries from foreign competition and to generate revenue for the government. However, tariffs can also lead to increased prices for consumers and can create trade wars between countries.

Trump's Threats

President Trump has been known for his aggressive stance on trade policy. In his latest move, he threatened to impose new tariffs on EU countries, including Germany, France, and the UK. The proposed tariffs are in response to what Trump believes is unfair trade practices and subsidies for European airlines.

Impact on the Stock Market

The threat of new tariffs has caused a ripple effect throughout the stock market. Investors are worried about the potential for a trade war between the US and the EU, which could lead to higher prices for goods and services and slower economic growth.

Sector-Specific Impacts

The impact of the proposed tariffs has been felt across various sectors. The technology sector, which includes companies like Apple and Microsoft, has seen a significant drop in stock prices. This is because a trade war could lead to higher costs for these companies, as they rely heavily on imports from the EU.

Similarly, the auto industry has also been affected. Companies like Volkswagen and BMW, which have significant operations in the US, could face increased costs due to the proposed tariffs. This has led to a decline in stock prices for companies in this sector.

Case Studies

One of the most notable examples of the impact of tariffs on the stock market is the case of Boeing. The company has been involved in a trade dispute with the EU over subsidies for Airbus. As a result of the dispute, Boeing has faced higher costs and increased competition, leading to a drop in stock prices.

Conclusion

The threat of new tariffs on EU countries has sent shockwaves through the US stock market. Investors are concerned about the potential for a trade war, which could have significant implications for the economy and stock prices. As the situation continues to unfold, it remains to be seen how the stock market will respond.

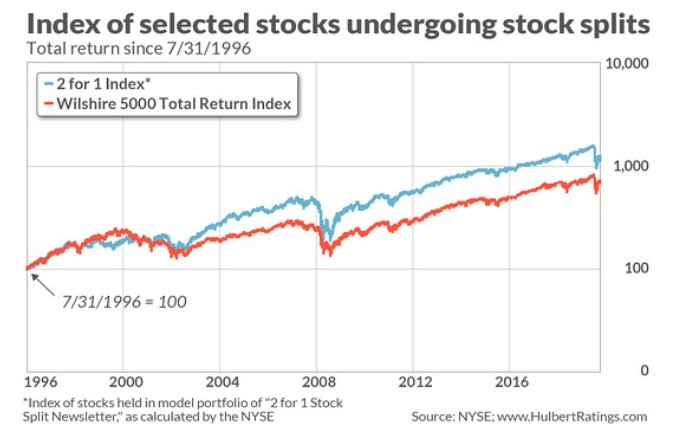

NYSE Composite