Insider(2)Ownershi(1)Stocks(1515)GROWTH(58)

In the ever-evolving world of the stock market, understanding the ownership dynamics of companies, particularly growth stocks, is crucial. One of the most significant factors to consider is insider ownership. This article delves into the concept of insider ownership, its impact on US growth stocks, and the insights it provides to investors.

What is Insider Ownership?

Insider ownership refers to the percentage of a company's shares that are held by its insiders, including the company's officers, directors, and major shareholders. This ownership stake gives these individuals a vested interest in the company's success and performance.

The Significance of Insider Ownership in US Growth Stocks

1. Alignment of Interests

Insider ownership is a strong indicator of alignment between management and shareholders. When insiders hold a significant stake in the company, they are more likely to act in the best interest of the company's long-term growth, rather than short-term gains. This can be particularly beneficial for growth stocks, where long-term growth potential is a key factor.

2. Confidence and Trust

Insiders who hold a substantial stake in the company often signal confidence in its future prospects. This can instill trust and confidence in other investors, leading to increased interest in the stock and potentially driving up its price.

3. Influence on Decision-Making

Insiders with a significant ownership stake can exert influence on the company's strategic decisions. This can be advantageous for growth stocks, as these decisions are often aimed at maximizing long-term value and growth.

Case Study: Apple Inc.

One notable example of the impact of insider ownership on a growth stock is Apple Inc. With a significant portion of its shares held by its executives and major shareholders, Apple's insiders have demonstrated a strong commitment to the company's growth and innovation. This has translated into consistent performance and a loyal shareholder base, making Apple one of the most valuable companies in the world.

Insights from Insider Ownership Data

1. Performance Metrics

Analyzing insider ownership data can provide valuable insights into a company's performance. Companies with a higher insider ownership percentage often tend to outperform those with lower percentages, suggesting that insiders have a better understanding of the company's potential.

2. Market Trends

Insider ownership data can also be used to identify market trends and potential investment opportunities. By monitoring changes in insider ownership, investors can gain insights into the strategies and intentions of company management.

Conclusion

Understanding the role of insider ownership in US growth stocks is crucial for investors seeking to make informed decisions. By analyzing insider ownership data, investors can gain valuable insights into a company's potential for growth, alignment of interests, and market trends. As always, it is essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

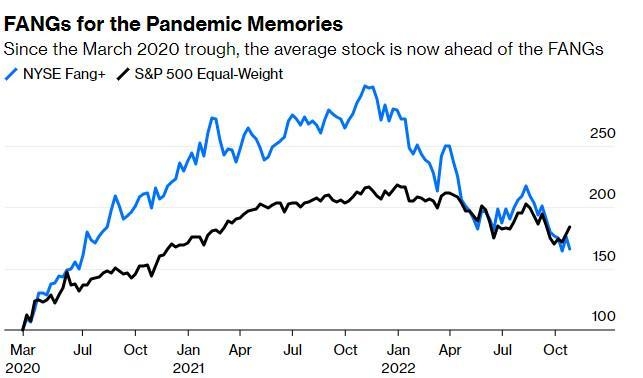

NYSE Composite