Best(309)TRADE(89)Stocks(1515)China(104)Title(866)

Introduction: The ongoing trade tensions between the United States and China have been a hot topic in the financial world. With the recent progress in negotiations, investors are eager to know which US stocks could benefit the most from a potential China trade deal. In this article, we will explore the best US stocks that could see significant growth if a trade agreement is reached between the two countries.

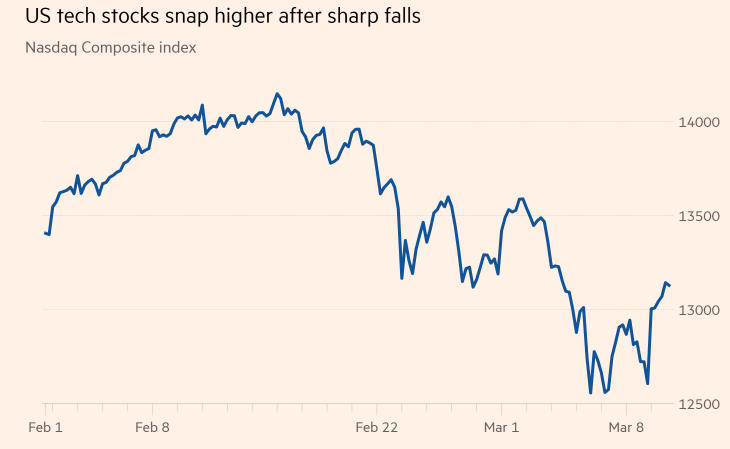

- Technology Stocks Technology stocks have been hit hard by the trade war, but they also have the potential to benefit the most from a China trade deal. Companies like Apple (AAPL), Microsoft (MSFT), and Intel (INTC) have a significant presence in the Chinese market. A trade deal could lead to increased sales and reduced tariffs, boosting their bottom lines.

Apple (AAPL): As the world's largest technology company, Apple has a strong presence in China. A trade deal could lead to increased sales of iPhones and other products, as well as reduced tariffs on components.

Microsoft (MSFT): Microsoft's cloud computing division, Azure, has seen significant growth in China. A trade deal could help the company expand its market share and increase revenue.

Intel (INTC): Intel has been struggling to gain market share in China. A trade deal could help the company overcome trade barriers and increase its presence in the Chinese market.

- Consumer Goods Stocks Consumer goods companies that have a significant presence in China, such as Procter & Gamble (PG) and Coca-Cola (KO), could also benefit from a trade deal. Reduced tariffs and increased demand for their products could lead to higher revenue and profits.

Procter & Gamble (PG): P&G has a strong presence in China, with a wide range of consumer products. A trade deal could lead to increased sales and reduced costs, improving the company's financial performance.

Coca-Cola (KO): Coca-Cola is one of the most popular beverage companies in China. A trade deal could help the company expand its market share and increase sales, leading to higher revenue and profits.

- Energy Stocks Energy stocks, such as ExxonMobil (XOM) and Chevron (CVX), could also benefit from a China trade deal. Increased demand for energy products in China could lead to higher prices and increased revenue for these companies.

ExxonMobil (XOM): As one of the world's largest oil and gas companies, ExxonMobil has a significant presence in China. A trade deal could lead to increased demand for its products, improving the company's financial performance.

Chevron (CVX): Chevron is another major player in the energy sector, with a significant presence in China. A trade deal could help the company expand its market share and increase revenue.

- Financial Stocks Financial stocks, such as JPMorgan Chase (JPM) and Goldman Sachs (GS), could also benefit from a China trade deal. Increased trade between the two countries could lead to higher revenue for these companies.

JPMorgan Chase (JPM): JPMorgan Chase has a significant presence in China, with operations in investment banking, asset management, and consumer banking. A trade deal could lead to increased revenue from these operations.

Goldman Sachs (GS): Goldman Sachs has also been impacted by the trade tensions between the United States and China. A trade deal could help the company expand its market share and increase revenue.

Conclusion: As the trade negotiations between the United States and China continue, investors are closely watching for potential breakthroughs. The stocks mentioned in this article could see significant growth if a trade deal is reached. By investing in these companies, investors can position themselves to benefit from the potential economic gains that could result from a China trade deal.

NYSE Composite