Housing(6)Average(33)AGE(7)the(2086)Stock(13053)

In the United States, the average age of the housing stock is a critical indicator of the nation's housing market health. Understanding this age helps policymakers, real estate professionals, and homeowners make informed decisions. This article delves into the average age of US housing stock, its implications, and the factors contributing to this age.

What is the Average Age of US Housing Stock?

As of 2021, the average age of the US housing stock stands at approximately 37 years. This means that the majority of homes in the country were built before the early 1980s. However, it's important to note that this average masks significant variations across different regions and housing types.

Factors Contributing to the Average Age

Several factors contribute to the aging US housing stock:

Historical Construction Trends: The post-World War II era saw a significant increase in housing construction. As these homes age, they contribute to the overall average age of the housing stock.

Economic Factors: Economic downturns can slow down new construction and home renovations, leading to an older housing stock.

Demographic Shifts: The aging population means that many older homes are being passed down to younger generations, contributing to their longevity.

Implications of an Aging Housing Stock

The aging US housing stock has several implications:

Maintenance and Repair Costs: Older homes often require more maintenance and repairs, which can be costly for homeowners.

Energy Efficiency: Older homes tend to be less energy-efficient, leading to higher utility bills and a greater environmental impact.

Safety Concerns: Older homes may not meet current safety standards, posing potential risks to residents.

Case Studies

To illustrate the impact of an aging housing stock, consider the following case studies:

Chicago, Illinois: The city has a significant number of older homes, many of which were built in the late 19th and early 20th centuries. This has led to high maintenance costs and concerns about energy efficiency.

Phoenix, Arizona: Despite being a relatively young city, Phoenix has an aging housing stock due to the rapid growth in the past few decades. This has led to a need for increased maintenance and repairs.

Conclusion

Understanding the average age of the US housing stock is crucial for policymakers, real estate professionals, and homeowners. The aging housing stock presents several challenges, including higher maintenance costs, reduced energy efficiency, and safety concerns. Addressing these issues requires a coordinated effort from all stakeholders to ensure a sustainable and healthy housing market.

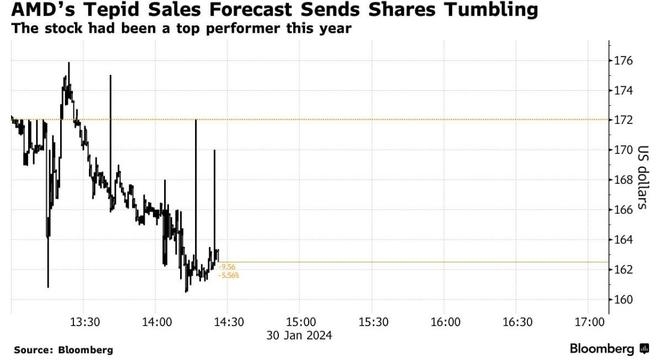

NYSE Composite