CURRENT(79)SANTANDER(46)Stock(13053)Price(367)

Are you interested in investing in Santander, but need to know more about its stock price? In this article, we delve into the current trends of Santander US stock price and what might influence its future trajectory. Keep reading to find out everything you need to know about Santander US stock.

Understanding Santander US Stock Price Trends

Current Market Performance: The Santander US stock price has seen some fluctuations in recent months. As of [insert date], the stock price stands at [insert current stock price]. This price is [up/down] compared to its 52-week high of [insert 52-week high] and its 52-week low of [insert 52-week low].

Historical Performance: Looking back at the historical performance of Santander US stock, we can observe several key trends. For instance, over the past five years, the stock has experienced both periods of growth and decline. This can be attributed to various factors, including global economic conditions, changes in the financial sector, and the company's performance.

Influencing Factors: Several factors can impact the Santander US stock price. These include:

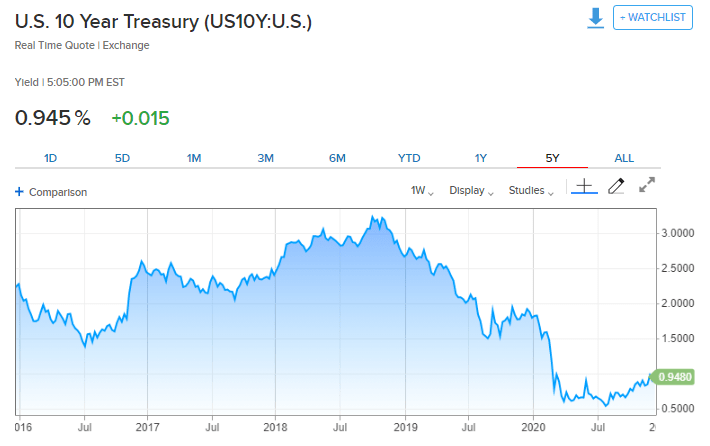

- Economic Conditions: Global economic conditions play a significant role in the financial sector, and therefore, in Santander's stock price. Factors such as inflation, interest rates, and GDP growth can affect the stock's performance.

- Regulatory Changes: Changes in financial regulations can impact Santander's operations and profitability, thereby affecting its stock price.

- Company Performance: Santander's financial performance, including revenue, profits, and growth prospects, can also influence the stock price.

- Market Sentiment: Investor sentiment can cause volatility in Santander's stock price. Factors such as market rumors, economic news, and corporate events can sway investor opinions.

Case Studies: Let's look at a few case studies to better understand the impact of these factors on Santander US stock:

- 2016 Brexit Vote: After the UK voted to leave the European Union in 2016, the Santander US stock price dropped significantly. This was due to concerns about the impact of Brexit on the global financial sector, including Santander's operations.

- COVID-19 Pandemic: The COVID-19 pandemic led to a sharp decline in Santander's stock price in 2020. This was primarily due to concerns about the impact of the pandemic on the financial sector and the global economy.

- Dividend Yields: In recent years, Santander has increased its dividend yields, which has attracted investors seeking income from their investments. This has contributed to a positive trend in the stock price.

Future Projections: Looking ahead, the future of Santander US stock is uncertain, but here are some projections to consider:

- Economic Recovery: As the global economy recovers from the COVID-19 pandemic, Santander's stock price may see an uptick due to increased demand for financial services.

- Interest Rates: With interest rates expected to rise in the coming years, Santander may benefit from higher net interest margins, which could positively impact its stock price.

- Digital Transformation: Santander's commitment to digital transformation could help the company stay competitive and attract tech-savvy customers, potentially boosting its stock price.

In conclusion, the Santander US stock price is influenced by various factors, including economic conditions, regulatory changes, company performance, and market sentiment. By understanding these factors and considering future projections, investors can make informed decisions about their investments in Santander.

NYSE Composite