CAN(152)Stocks(1515)Buy(324)How(320)CANADIAN(74)Th(138)

Introduction

Investing in Canadian stocks can be a great way to diversify your portfolio and take advantage of the strong Canadian economy. If you're an American investor looking to buy Canadian stocks, you may be wondering how to go about it. In this article, we'll explore the different methods available to you and provide some tips on how to get started.

Understanding the Difference Between Canadian and U.S. Stocks

Before diving into the specifics of buying Canadian stocks, it's important to understand the difference between Canadian and U.S. stocks. While both are publicly traded, there are some key differences to keep in mind:

- Currency: Canadian stocks are denominated in Canadian dollars, while U.S. stocks are denominated in U.S. dollars. This means that when you buy Canadian stocks, you'll be exposed to currency fluctuations.

- Regulation: The Canadian Securities Administrators (CSA) regulate the Canadian stock market, while the U.S. Securities and Exchange Commission (SEC) regulates the U.S. stock market.

- Taxation: Taxes on dividends and capital gains may vary between the two countries.

Methods to Buy Canadian Stocks in the US

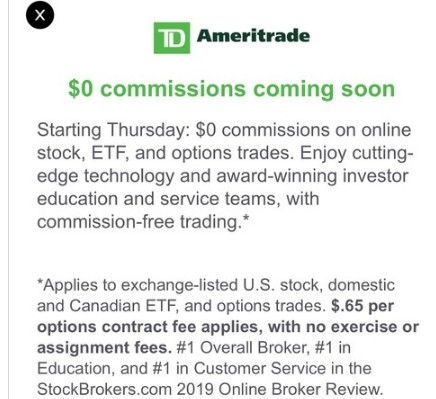

Brokerage Accounts: The most common way to buy Canadian stocks in the U.S. is through a brokerage account. Many U.S. brokers offer access to Canadian stocks, including TD Ameritrade, E*TRADE, and Charles Schwab.

Exchange-Traded Funds (ETFs): ETFs are a popular way to invest in a basket of Canadian stocks. They are traded on U.S. exchanges and can be bought and sold like stocks.

Dividend Reinvestment Plans (DRIPs): DRIPs allow you to reinvest your dividends in additional shares of a Canadian stock. This can be a cost-effective way to build your investment portfolio.

Direct Purchase Plans (DPPs): DPPs allow you to buy shares directly from a Canadian company. This can be a good option if you're looking to invest in a specific company.

Tips for Buying Canadian Stocks in the US

- Research: Before investing in Canadian stocks, it's important to do your research. Look at the company's financials, industry trends, and overall market conditions.

- Consider Currency Fluctuations: Be aware of the potential impact of currency fluctuations on your investment. If the Canadian dollar strengthens against the U.S. dollar, your returns may be higher.

- Understand Tax Implications: Make sure you understand the tax implications of investing in Canadian stocks. Consult with a tax professional if needed.

- Use a Reliable Broker: Choose a reputable brokerage firm that offers access to Canadian stocks. Look for brokers with low fees and a good track record of customer service.

Case Study: Investing in Canadian Banks

One popular sector among U.S. investors is Canadian banks. Canadian banks are known for their stability and strong financial performance. An example is the Toronto-Dominion Bank (TD Bank), which is one of the largest banks in Canada.

To invest in TD Bank, you can open a brokerage account with a U.S. broker that offers access to Canadian stocks. You can then purchase shares of TD Bank and benefit from its strong performance.

Conclusion

Buying Canadian stocks in the U.S. can be a great way to diversify your investment portfolio. By understanding the differences between Canadian and U.S. stocks, choosing the right method, and doing your research, you can successfully invest in Canadian stocks from the comfort of your own home.

NYSE Composite