Stocks(1515)Buy(324)Comprehens(103)CANADIAN(74)

Investing in U.S. stocks has become increasingly popular among Canadian investors. With the United States being home to some of the world's largest and most successful companies, it's no wonder that many Canadians are looking to diversify their portfolios by purchasing American equities. In this article, we'll explore the process of buying U.S. stocks from a Canadian perspective, including the benefits, the risks, and the steps involved.

Benefits of Buying U.S. Stocks

1. Diversification: One of the primary reasons why Canadian investors are interested in buying U.S. stocks is diversification. By investing in companies across different sectors and geographical regions, investors can reduce their exposure to the risks associated with investing in just one country's stock market.

2. Access to Top Companies: The U.S. stock market is home to many of the world's largest and most successful companies, including technology giants like Apple and Microsoft, as well as household names like Coca-Cola and Disney. Investing in these companies can provide investors with exposure to a wide range of industries and business models.

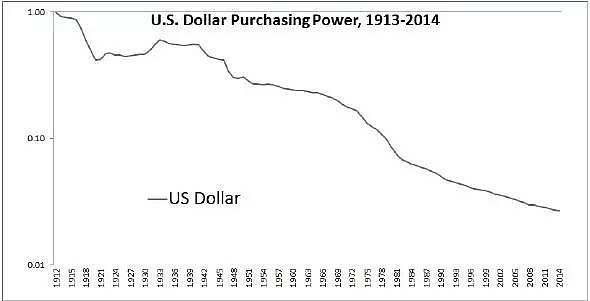

3. Currency Fluctuations: Another benefit of buying U.S. stocks is the potential for currency fluctuations. If the Canadian dollar strengthens against the U.S. dollar, the value of U.S. stocks owned by Canadian investors may increase when converted back to Canadian dollars.

Risks of Buying U.S. Stocks

While there are many benefits to buying U.S. stocks, it's important to be aware of the risks involved:

1. Currency Risk: The value of U.S. stocks can be affected by fluctuations in the exchange rate between the Canadian dollar and the U.S. dollar. If the Canadian dollar weakens, the value of U.S. stocks owned by Canadian investors may decrease when converted back to Canadian dollars.

2. Market Volatility: The U.S. stock market can be volatile, with prices fluctuating widely over short periods of time. This can be particularly risky for investors who are not prepared for the potential for significant price swings.

3. Tax Implications: Canadian investors who buy U.S. stocks may be subject to U.S. withholding taxes on dividends and capital gains. It's important to understand these tax implications before investing.

Steps to Buy U.S. Stocks

1. Open a Brokerage Account: The first step in buying U.S. stocks is to open a brokerage account. There are many online brokers that offer access to U.S. stocks, including TD Ameritrade, E*TRADE, and Charles Schwab.

2. Research and Select Stocks: Once you have a brokerage account, you'll need to research and select the stocks you want to buy. This can involve analyzing financial statements, reading news articles, and using stock research tools.

3. Place an Order: Once you've selected the stocks you want to buy, you can place an order through your brokerage account. You can choose to buy shares of individual companies, or you can invest in exchange-traded funds (ETFs) that track a basket of U.S. stocks.

4. Monitor Your Investments: After buying U.S. stocks, it's important to monitor your investments regularly. This can help you stay informed about the performance of your investments and make informed decisions about whether to buy, sell, or hold.

Case Study: Investing in Apple Inc.

One popular U.S. stock among Canadian investors is Apple Inc. (AAPL). As one of the world's largest and most valuable companies, Apple has been a consistent performer over the years. In 2020, Apple reported revenue of

Conclusion

Buying U.S. stocks can be a valuable part of a diversified investment portfolio for Canadian investors. By understanding the benefits and risks involved, and following the steps outlined in this article, investors can make informed decisions about their investments.

NYSE Composite