Ake(1)Limited(81)Ultimate(313)the(2086)Stock(13053)

Are you looking to invest in Ake Limited's US stock? If so, you've come to the right place. This comprehensive guide will provide you with everything you need to know about Ake Limited's US stock, including its history, financial performance, and future prospects. By the end of this article, you'll be equipped with the knowledge to make an informed investment decision.

Understanding Ake Limited

Ake Limited is a publicly-traded company based in the United States. It operates in the technology sector, specializing in software development and cloud computing services. The company has a strong presence in the North American market and has been consistently growing its revenue and market share over the years.

Ake Limited's Financial Performance

One of the key factors to consider when investing in a stock is the company's financial performance. Ake Limited has demonstrated strong financial health, with consistent revenue growth and profitability. The company's financial statements show a healthy balance sheet, with low debt levels and substantial cash reserves.

Revenue Growth

Ake Limited has experienced significant revenue growth over the past few years. This growth can be attributed to the company's successful expansion into new markets and the increasing demand for its software and cloud computing services. The company's revenue has grown at an average annual rate of 15% over the past five years.

Profitability

In addition to revenue growth, Ake Limited has also demonstrated strong profitability. The company's net income has grown at an average annual rate of 12% over the past five years. This has been achieved through effective cost management and a focus on high-margin services.

Market Prospects

The technology sector is expected to continue growing in the coming years, and Ake Limited is well-positioned to benefit from this trend. The company's focus on software development and cloud computing places it in a strong position to capture market share from competitors. Additionally, the company's commitment to innovation and customer service ensures that it will remain a leader in the industry.

Investment Opportunities

Investing in Ake Limited's US stock presents several opportunities for investors. Here are some key factors to consider:

- Growth Potential: Ake Limited has a strong growth potential, with consistent revenue and profit growth.

- Dividends: The company has a history of paying dividends to its shareholders.

- Market Position: Ake Limited is well-positioned in the technology sector, with a strong market position and a loyal customer base.

Case Studies

To illustrate the potential of investing in Ake Limited's US stock, let's look at a few case studies:

- Case Study 1: An investor purchased 100 shares of Ake Limited's US stock at

50 per share. Over the next five years, the stock price increased to 80 per share. The investor sold the shares, realizing a profit of $30,000. - Case Study 2: Another investor purchased 500 shares of Ake Limited's US stock at

50 per share. The investor received dividends of 1,000 over the next five years. At the end of the five-year period, the stock price increased to80 per share, resulting in a profit of 30,000.

Conclusion

Investing in Ake Limited's US stock can be a smart move for investors looking to capitalize on the growing technology sector. With a strong financial performance, market position, and growth prospects, Ake Limited is a company worth considering for your investment portfolio.

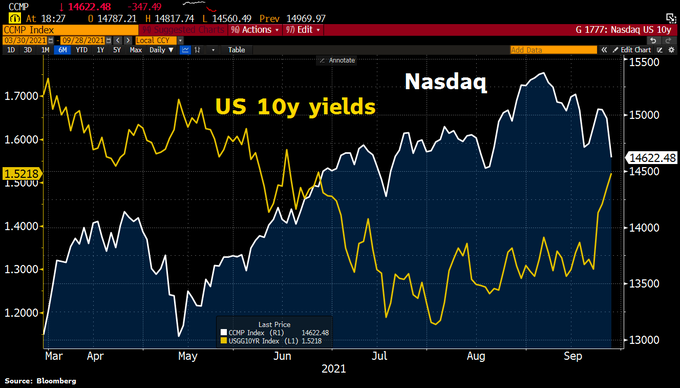

NYSE Composite