Comparat(1)INDIA(48)Per(12)JAPAN(107)Stock(13053)

In today's globalized economy, understanding the stock market dynamics of different countries is crucial for investors. This article delves into a comparative analysis of the stock markets in the United States, India, and Japan, focusing on key aspects such as market size, performance, and investment opportunities.

Market Size

The United States boasts the largest stock market in the world, with a market capitalization of over

Performance

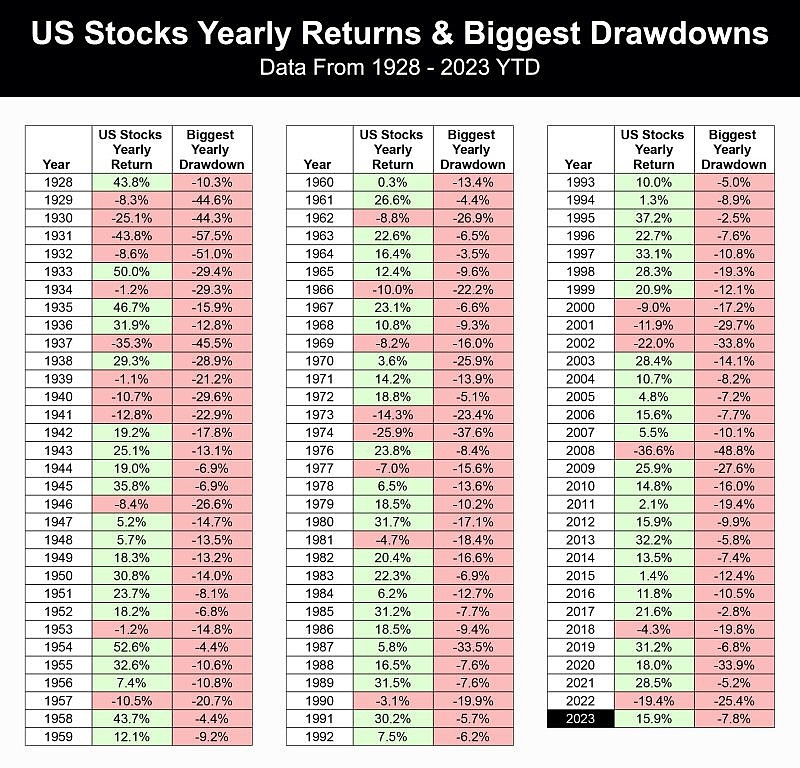

Over the past decade, the U.S. stock market has outperformed both India and Japan. The S&P 500 has delivered an average annual return of around 14%, while the Nifty 50 index in India has returned approximately 12%. Japan's Nikkei 225 index, however, has lagged behind, with an average annual return of just 6%. This performance gap can be attributed to various factors, including economic conditions, market structure, and investor sentiment.

Investment Opportunities

United States:

The U.S. stock market offers a wide range of investment opportunities across various sectors. Technology, healthcare, and consumer discretionary sectors have been the standout performers in recent years. Companies like Apple, Amazon, and Microsoft have become global giants, commanding significant market share. For investors seeking exposure to the U.S. market, ETFs and mutual funds are popular choices.

India:

India's stock market has been witnessing rapid growth, driven by factors such as a young population, increasing urbanization, and government reforms. The IT and finance sectors have been the major contributors to this growth. Companies like TCS, Infosys, and HDFC Bank have emerged as market leaders. For those looking to invest in India, direct investment in stocks or through ETFs can be viable options.

Japan:

Japan's stock market offers a mix of both growth and value opportunities. The automotive, robotics, and pharmaceutical sectors are key areas for investment. Companies like Toyota, Sony, and Takeda Pharmaceuticals have a strong global presence. For investors interested in Japan, it is advisable to focus on large-cap companies with stable earnings.

Case Studies

A notable example of successful investment in the U.S. market is the case of Tesla, Inc. Since its initial public offering (IPO) in 2010, Tesla's stock has skyrocketed, delivering an annualized return of over 40%. This highlights the potential for high returns in the U.S. stock market, especially in the technology sector.

In India, the IPO of Paytm in 2019 was a significant event. The company raised over $2 billion, making it one of the largest IPOs in India's history. Paytm's stock has since seen significant growth, showcasing the potential of the Indian stock market for new-age companies.

In Japan, the acquisition of AstraZeneca by Pfizer in 2019 was a major deal. The combined entity became one of the world's largest pharmaceutical companies, demonstrating the potential for cross-border investments in Japan.

Conclusion

Investing in stocks across different countries requires a thorough understanding of market dynamics, performance, and investment opportunities. The U.S., India, and Japan offer unique investment prospects, each with its own set of strengths and challenges. By analyzing these markets, investors can make informed decisions and capitalize on global growth opportunities.

NASDAQ Composite