Residents(4)CAN(152)Buy(324)CANADIAN(74)Sto(195)

Are you a Canadian resident looking to diversify your investment portfolio? Investing in US stocks can be an attractive option, but you may be wondering if it's possible for you to do so. In this article, we'll explore the process of buying US stocks for Canadian residents, including the necessary steps, fees, and potential tax implications.

Understanding the Basics

Firstly, it's important to understand that Canadian residents are indeed eligible to purchase US stocks. However, there are a few key considerations to keep in mind. One of the most significant factors is the currency exchange rate, as you'll need to convert Canadian dollars to US dollars to make your investments.

Steps to Buy US Stocks

Open a Brokerage Account: The first step is to open a brokerage account with a firm that allows international trading. Many major brokerage firms, such as TD Ameritrade, E*TRADE, and Charles Schwab, offer accounts that cater to Canadian residents.

Choose Your Investments: Once your account is set up, you can start researching and selecting US stocks to invest in. This can be done through the brokerage platform, which typically provides access to a wide range of research tools and resources.

Convert Currency: To purchase US stocks, you'll need to convert your Canadian dollars to US dollars. Most brokerage firms offer a currency conversion service, which may involve a fee. It's important to compare fees and exchange rates to find the most cost-effective option.

Place Your Order: Once you've chosen your investments and converted your currency, you can place your order through the brokerage platform. You can choose to buy shares of individual companies or invest in exchange-traded funds (ETFs) that track specific market indexes.

Monitor Your Investments: After placing your order, it's important to regularly monitor your investments. This can help you stay informed about market trends and make informed decisions about when to buy or sell.

Tax Implications

One of the key considerations for Canadian residents investing in US stocks is the tax implications. Here are a few key points to keep in mind:

- Withholding Tax: When you purchase US stocks, the company may withhold a portion of your dividends to cover US tax obligations. This is known as a withholding tax.

- Reporting: You'll need to report your US stock investments on your Canadian tax return, including any dividends received and any capital gains or losses.

- Tax Planning: It's important to consult with a tax professional to understand the specific tax implications of investing in US stocks as a Canadian resident.

Case Study: Investing in US Stocks

Let's consider a hypothetical scenario. John, a Canadian resident, decides to invest $10,000 in US stocks. He chooses a mix of individual companies and ETFs that track the S&P 500 index. Over the next year, his investments increase in value by 15%.

When it comes time to sell his investments, John will need to consider the tax implications. He'll need to pay capital gains tax on the $1,500 profit he made, which will be calculated based on his marginal tax rate in Canada. Additionally, he'll need to report any dividends received on his Canadian tax return.

Conclusion

In conclusion, Canadian residents can certainly buy US stocks, but it's important to understand the process and consider the associated fees and tax implications. By carefully planning and researching, you can successfully diversify your investment portfolio and potentially benefit from the opportunities available in the US stock market.

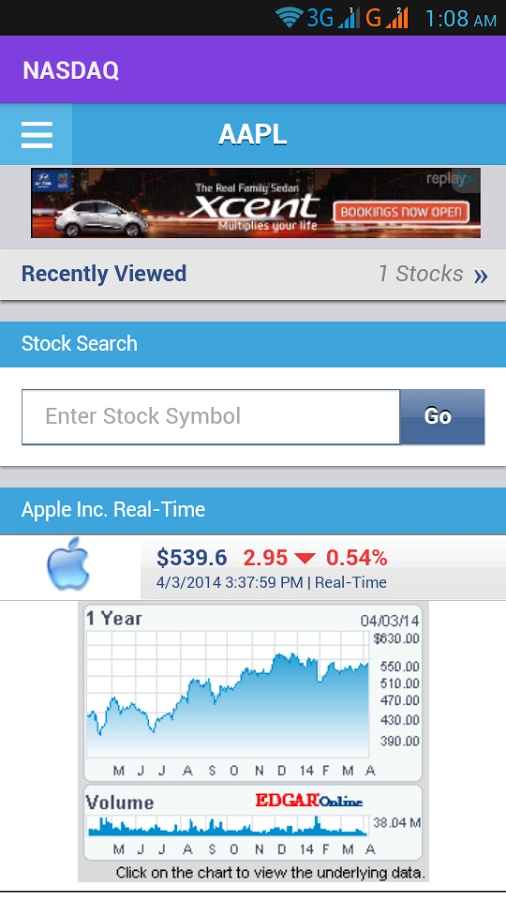

NASDAQ Composite