Good(23)Picks(65)2(24)Buy(324)For(175)TOP(489)Stock(13053)

In the ever-evolving world of stock markets, finding a good US stock to buy can be a daunting task. However, with the right strategy and research, investors can identify promising opportunities. This article delves into some of the top US stocks to consider for 2023, offering insights into their potential and market trends.

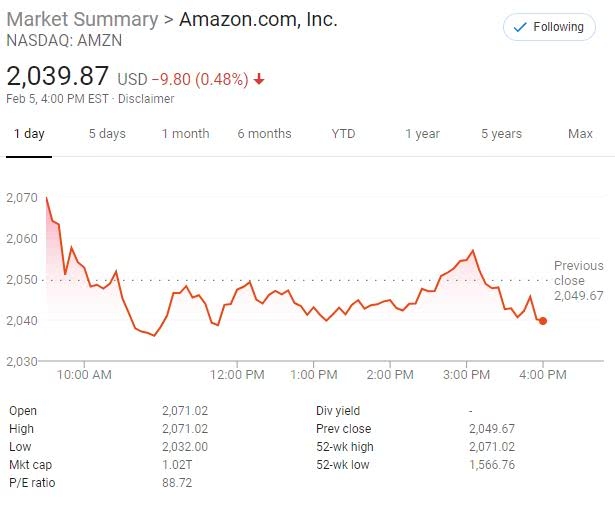

1. Amazon (AMZN)

Amazon has long been a staple in the tech industry, and its dominance shows no signs of slowing down. As an e-commerce giant, Amazon has a diverse portfolio that includes cloud computing through Amazon Web Services (AWS). With a strong market position and a commitment to innovation, AMZN remains a solid investment choice.

2. Tesla (TSLA)

Tesla has revolutionized the automotive industry with its electric vehicles (EVs). As the world shifts towards sustainability, Tesla's market share is expected to grow. TSLA's innovative approach to EV technology and its expansion into new markets make it a compelling stock to watch.

3. Apple (AAPL)

Apple is a household name, and its stock has consistently delivered strong returns over the years. With a robust product lineup, including the iPhone, iPad, and Mac, Apple has a loyal customer base. Additionally, the company's services segment, which includes Apple Music and iCloud, has been a significant driver of growth.

4. Microsoft (MSFT)

Microsoft has transformed itself from a software company to a leader in cloud computing. With its Azure platform, Microsoft is well-positioned to capitalize on the growing demand for cloud services. MSFT's strong financial performance and commitment to innovation make it a solid investment choice.

5. NVIDIA (NVDA)

NVIDIA is a leader in the graphics processing unit (GPU) market, and its technology is crucial for various industries, including gaming, AI, and autonomous vehicles. With a strong pipeline of new products and partnerships, NVDA is poised for continued growth.

6. Intel (INTC)

Intel has been a staple in the semiconductor industry, and its focus on 5G and AI technology positions it for future growth. While the company has faced challenges in the past, its recent strategic shifts and investments in new technologies make it a potential long-term winner.

7. Meta Platforms (META)

Meta Platforms (formerly Facebook) has been at the forefront of social media and digital advertising. With its strong user base and innovative ad products, Meta is well-positioned to continue its growth trajectory. As the company expands into new areas, such as the metaverse, its stock could offer significant upside.

8. Johnson & Johnson (JNJ)

Johnson & Johnson is a diversified healthcare company with a strong presence in pharmaceuticals, consumer healthcare, and medical devices. JNJ's commitment to innovation and its diverse product portfolio make it a stable investment choice.

9. Procter & Gamble (PG)

Procter & Gamble is a leader in the consumer goods industry, with a wide range of brands, including Gillette, Pampers, and Tide. With a strong focus on emerging markets and continuous innovation, PG is well-positioned for long-term growth.

When selecting a good US stock to buy, it's crucial to conduct thorough research and consider factors such as the company's financial health, market position, and growth prospects. By analyzing these factors, investors can make informed decisions and potentially achieve strong returns.

Index Fund