Status(1)Oc(1)CURRENT(79)Market(808)Stock(13053)

The US stock market has always been a key indicator of the country's economic health. As we step into October 2025, it's crucial to understand the current status of the market and what it means for investors. This article delves into the latest trends, key sectors, and potential risks in the US stock market, providing a comprehensive overview for investors and traders.

Market Performance

As of October 2025, the US stock market has shown a steady growth trend over the past year. The S&P 500, a widely followed index, has seen a significant increase, driven by strong corporate earnings and a recovering economy. However, it's important to note that the market has experienced some volatility, with several factors contributing to this uncertainty.

Key Sectors

Several sectors have emerged as leaders in the US stock market in October 2025. Technology remains a dominant force, with companies like Apple, Microsoft, and Amazon continuing to post impressive growth. The healthcare sector has also seen significant gains, driven by advancements in biotechnology and increased demand for medical services. Financials and energy sectors have also performed well,受益于低利率环境和全球能源需求的增长。

Volatility Factors

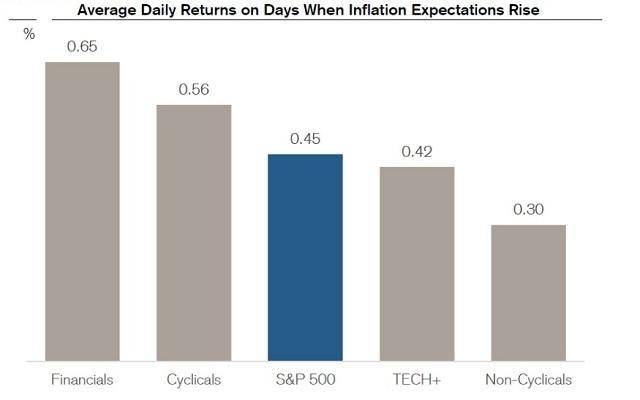

Despite the overall positive trend, several factors have contributed to market volatility. Inflation remains a concern, with the Consumer Price Index (CPI) showing signs of slowing down but still remaining above the Federal Reserve's target rate. Geopolitical tensions between major economies have also added to the uncertainty, with investors closely monitoring developments in key regions such as Asia and Europe.

Stock Market Indices

The major US stock market indices have shown mixed results in October 2025. The Dow Jones Industrial Average has experienced some volatility but remains in positive territory for the year. The S&P 500 has seen significant growth, driven by strong corporate earnings and a recovering economy. The NASDAQ Composite has also performed well, with technology stocks leading the charge.

Investment Strategies

Given the current market conditions, investors should consider adopting a diversified investment strategy. This includes allocating capital across different sectors and asset classes to mitigate risk. Value investing remains a popular strategy, with investors seeking out undervalued stocks that have the potential for long-term growth. Growth investing is also gaining traction, with investors focusing on companies with strong revenue growth and potential for future expansion.

Case Studies

Several companies have emerged as leaders in the stock market in October 2025. Tesla has seen significant growth, driven by its leadership in the electric vehicle market. The company's strong financial performance and innovative technology have made it a favorite among investors. Meta Platforms (formerly Facebook) has also experienced growth, with the company expanding its advertising business and exploring new revenue streams.

In conclusion, the US stock market in October 2025 is showing a positive trend, with several sectors leading the charge. However, investors should remain cautious and adopt a diversified investment strategy to mitigate risk. By staying informed and adapting to market conditions, investors can navigate the complex landscape of the US stock market and achieve their financial goals.

Index Fund