Affected(2)U.(5)Stocks(1515)Are(89)CHINESE(50)

In the ever-evolving global financial landscape, the interconnectedness of stock markets has become more pronounced than ever. One of the most intriguing questions investors often ponder is whether Chinese stocks are influenced by the fluctuations in U.S. stocks. This article delves into this topic, exploring the relationship between these two major markets and how they influence each other.

Understanding the Interconnectedness

The relationship between Chinese and U.S. stocks is complex and multifaceted. Both markets are significant players in the global financial arena, with China being the second-largest economy in the world and the U.S. being the largest. This interconnectedness is evident in several key aspects:

- Trade Relations: The trade relationship between the U.S. and China has a significant impact on both markets. Any trade disputes or agreements can lead to volatility in both markets.

- Investor Sentiment: Investors in both markets often share similar sentiment, which can lead to synchronized movements in stock prices.

- Economic Indicators: Economic indicators from both countries, such as GDP growth rates, inflation, and employment data, can influence investor sentiment and stock prices in both markets.

U.S. Stock Market Impact on Chinese Stocks

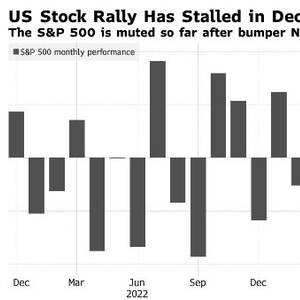

The U.S. stock market, particularly the S&P 500, has a significant impact on Chinese stocks. Here's how:

- Market Sentiment: When the U.S. stock market is performing well, it tends to boost investor confidence worldwide, including in China. This can lead to increased demand for Chinese stocks, driving up their prices.

- Dollar Strength: The U.S. dollar is often considered a safe-haven currency. When the dollar strengthens, it can make Chinese stocks more expensive for foreign investors, potentially leading to a decrease in demand and, consequently, a decline in stock prices.

- Tech Sector Influence: The tech sector is a significant component of both the U.S. and Chinese stock markets. Any developments in the U.S. tech sector, such as earnings reports or regulatory changes, can have a ripple effect on Chinese tech stocks.

Chinese Stock Market Impact on U.S. Stocks

Similarly, the Chinese stock market can influence U.S. stocks in several ways:

- Global Economic Growth: China is a major driver of global economic growth. Any slowdown in the Chinese economy can have a negative impact on U.S. stocks, particularly those companies with significant exposure to the Chinese market.

- Consumer Demand: Chinese consumers play a crucial role in the global demand for goods and services. Any changes in Chinese consumer spending patterns can affect U.S. companies that rely on Chinese demand.

- Currency Fluctuations: The Chinese yuan's value can impact U.S. stocks, particularly those with significant operations in China. A weaker yuan can make Chinese goods cheaper for U.S. consumers, benefiting U.S. companies, while a stronger yuan can have the opposite effect.

Case Study: Trade War Impact

One notable example of the relationship between Chinese and U.S. stocks is the trade war between the two countries in 2018-2019. The trade tensions led to increased volatility in both markets, with Chinese stocks falling sharply in response to U.S. tariffs and other trade measures. Similarly, U.S. stocks were also affected, as the trade war raised concerns about global economic growth and corporate profitability.

Conclusion

The relationship between Chinese and U.S. stocks is complex and interconnected. While U.S. stocks can influence Chinese stocks through various channels, such as market sentiment and economic indicators, the reverse is also true. Investors need to be aware of these dynamics to make informed decisions in the global stock market.

Index Fund