Fall(7)Lower(3)Major(16)Y(26)Stocks(1515)What(182)

The stock market is a dynamic entity that can fluctuate dramatically in a short span of time. In recent weeks, major US stocks have experienced a significant downturn, prompting investors and market analysts to question the underlying causes and potential implications. This article delves into the reasons behind the fall, the impact on investors, and the broader market trends.

Reasons for the Downturn

Several factors have contributed to the decline in major US stocks. Firstly, the Federal Reserve's decision to raise interest rates has made borrowing more expensive, which can negatively impact corporate earnings. Secondly, the ongoing trade tensions between the US and China have created uncertainty in the global economy, leading to a decrease in investor confidence. Lastly, the rise in inflation has eroded purchasing power, further dampening market sentiment.

Impact on Investors

The fall in major US stocks has had a significant impact on investors. Many individuals and institutions have seen their portfolios decline in value, leading to increased anxiety and concern. However, it is important to remember that stock market fluctuations are a normal part of investing. Investors should focus on long-term goals and not react impulsively to short-term volatility.

Broader Market Trends

The decline in major US stocks is not isolated to a specific sector or industry. Instead, it reflects broader market trends that are affecting the entire economy. For example, the technology sector, which has been a major driver of the stock market's growth in recent years, has also experienced a downturn. This highlights the interconnected nature of the stock market and the importance of diversifying investments.

Case Studies

To illustrate the impact of the downturn, let's look at two case studies. Firstly, consider a tech company that had seen its stock price soar over the past few years. However, due to the rising interest rates and trade tensions, the company's earnings projections were lowered, leading to a significant decline in its stock price. Secondly, a retail company that had been performing well saw its stock price fall as inflation eroded consumer spending power.

Conclusion

In conclusion, the recent fall in major US stocks is a result of a combination of factors, including rising interest rates, trade tensions, and inflation. While this has had a significant impact on investors, it is important to maintain a long-term perspective and focus on diversifying investments. The interconnected nature of the stock market means that fluctuations in one sector can have a ripple effect on the entire market, making it crucial for investors to stay informed and make informed decisions.

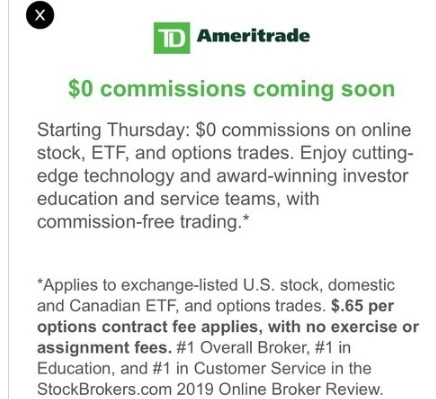

American stock trading