AWS(1)Trends(17)Analysi(15)Stock(13053)Price(367)

Amidst the bustling tech industry, Amazon Web Services (AWS) has emerged as a dominant player, captivating investors and enthusiasts alike. As the cloud computing market continues to expand, the stock price of AWS has become a focal point for many. This article delves into the trends, analysis, and future outlook of the AWS stock price.

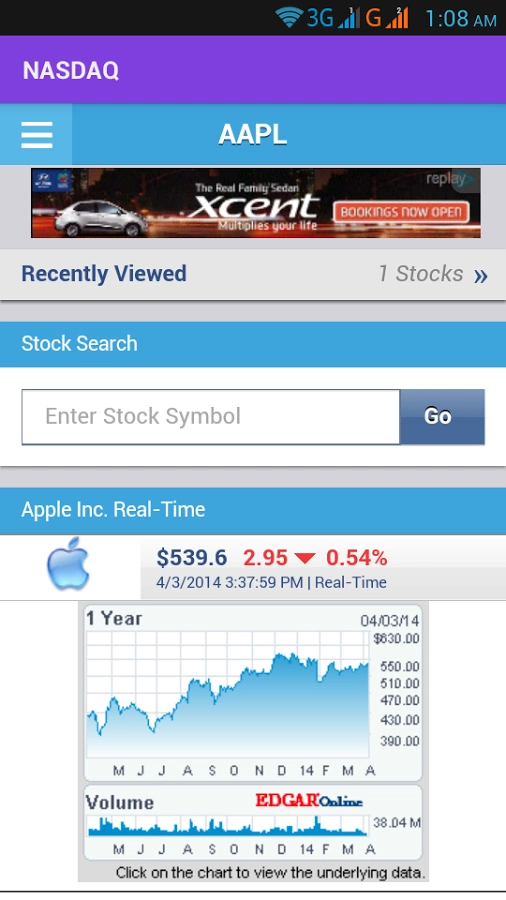

Understanding AWS Stock Price Trends

The AWS stock price has seen a rollercoaster ride over the years. After its initial public offering (IPO) in 1997, the stock price surged, reaching an all-time high of over $3,000 per share in 2021. This impressive growth can be attributed to AWS's robust revenue growth, innovative cloud services, and strategic partnerships.

Over the past few years, the stock has experienced both highs and lows. In the wake of the global pandemic, demand for cloud services skyrocketed, propelling the stock price to new heights. However, market volatility and economic uncertainties have led to fluctuations in the stock price.

Key Factors Influencing AWS Stock Price

Several factors contribute to the AWS stock price movements. These include:

- Revenue Growth: AWS's consistent revenue growth has been a major driver behind its stock price appreciation. The company has successfully expanded its services and customer base, leading to increased revenue and profitability.

- Market Competition: The cloud computing market is highly competitive, with major players like Microsoft Azure and Google Cloud Platform vying for market share. Any significant shift in the competitive landscape can impact AWS's stock price.

- Economic Conditions: Economic factors such as inflation, interest rates, and geopolitical tensions can influence investor sentiment and affect the stock price.

- Strategic Partnerships: AWS's strategic partnerships with industry leaders can provide a competitive edge and drive growth, potentially impacting the stock price.

Analysis of AWS Stock Price

To gain a deeper understanding of the AWS stock price, let's examine some key milestones:

- Q1 2020: The stock price experienced a significant surge as demand for cloud services surged during the pandemic.

- Q2 2020: The stock price reached an all-time high of $3,000 per share, driven by strong revenue growth and market optimism.

- Q3 2020: The stock price experienced a minor pullback as investors started to price in the potential risks of the pandemic.

- Q4 2020: The stock price recovered and continued to rise, reflecting the strong growth momentum of AWS.

Future Outlook for AWS Stock Price

Looking ahead, several factors suggest that the AWS stock price may continue to perform well:

- Expanding Cloud Market: The global cloud computing market is expected to grow at a CAGR of 12% over the next few years, providing a robust growth environment for AWS.

- Innovation and Expansion: AWS continues to innovate and expand its service offerings, making it a compelling investment opportunity.

- Strategic Partnerships: The company's strategic partnerships with industry leaders will likely drive growth and improve its competitive position.

In conclusion, the AWS stock price has been a significant topic of interest for investors and tech enthusiasts alike. With a strong revenue growth track record, competitive edge, and a promising future outlook, AWS remains a compelling investment opportunity.

American stock trading